Amit Agarwal, Managing Director, UK writes about customer and competition.

Ajeet Agarwal, Managing Director, India writes about employee growth at Outbooks.

XYZ (name changed) are local accountants based in Wiltshire, established in 2016.

This video shows how one of our clients (name changed) benefited both professionally and personally from outsourcing

An article explaining the steps you can take while using Dext.

A definitive guide on getting started with QuickBooks.

End of Year Reflection

by Amit Agarwal

To my fellow customers,

Thank you. Yes, thank you to our valued customers.

Every success we achieved in 2022 is just a reflection of the trust our customers and shareholders have in us. And their trust led to significant expansion in the market as we added close to 50 new accounts in 2022.

As UK battles through ongoing staff shortages, outsourcing seems to be a tempting option as it gives access to larger talent pool. The war for talent has reached unprecedented levels and it has led to mushrooming of outsourcing firms who are providing the services at a much cheaper cost. But it is important to keep in mind that cost reduction is no longer the number one driver for outsourcing, with the need to focus on core business the primary driver, followed closely by access to resources and talent.

With so many players in the market, it becomes important for outsourcing companies to create a niche. For the same, some outsourcing companies are working with only small firms in the total accounting outsourcing space helping the smaller firms’ space to grow.

It is a huge market and continues to grow massively. Unfortunately, it’s under penetrated compared to large firms where almost 100% of them outsource.

To be a winner you need three things:

- To be able to meaningfully co-create with clients

- Help them reduce time to market

- Contribute to both the top line and the bottom line

Despite the turbulent climate, I remain proud of what Outbooks and its employees have achieved, collectively and individually.

Year 2023 is upon us, we should relish the challenges that lie ahead.

On behalf of Outbooks Management and staff, I would like to wish you all a wonderful and rewarding new year.

Amit Agarwal

Managing Director, UK

OUTBOOKS

End of Year Reflection

by Ajeet Agarwal

I want to thank you for helping make 2022 a triumphant year.

Our daily endeavour is to make a difference in our clients' businesses and lives. To create a more seamless and efficient experience for our clients, we hired a Training and Development Manager to help employees stay updated with latest compliance and technological changes.

Outbooks has added a few partnerships with ACCA-approved learning centres and started placing many part qualified and fully-qualified ACCAs.

We have started the ACCA sponsorship programme and plan to add around 50 interns in the next 12 months under the internship and scholarship of that programme.

Despite the tremendous technological enhancements, Outbooks will always be a company that succeeds through its talent. We can take pride in the fact that we have doubled our strength since last year. The skills and expertise of our employees, when combined with our robust processes, differentiate us.

Last year the UK saw a massive staff shortage highlighting the importance of talent. The option of working remotely has also contributed to employees seeking new opportunities. With the resulting heightened competition for talent, understanding the workforce's needs has become more critical than ever.

Despite the turbulent economic climate, I am proud to share that the entire workforce of Outbooks received a performance appraisal, which was above market standards.

Geographically, we have been setting our foot gradually down under. In addition, we built a strong team in Ireland. While we continue to work remotely, we added two centres in Jaipur and Vadodara, India, with a team of 50+ in both centres.

I look forward to a brighter and safer 2023.

Ajeet Agarwal

Managing Director, UK

OUTBOOKS

Case Study

XYZ (name changed) are local accountants based in Wiltshire, established in 2016.

They offer a broad spectrum of accountancy services like Bookkeeping, Limited company accounts, Sole trader and partnership annual accounts, Payroll, Company Secretarial Services, Tax Advisory, and Management Accounts.

They faced several problems as they worked with a lot of physical data. Account owners spent too much time scanning and entering data into the systems. Most clients came with an old mindset, stored data in the shoe boxes, and needed to be more comfortable using modern approaches.

All this led to low morale in the team, resignations from the key members, and also unplanned sick leaves from the team members.

This further exacerbated the problem leading to delayed accounts filing and poor client experience. Even when the accounts were being filed because of too much pressure, they were being prepared with incomplete working papers. Finally, the impact was on the practice's top and bottom lines with lower revenues and losses.

Outbooks team sprang into action and applied various approaches to solving the issues. The highest priority task was getting some juniors on the team and scanning all the data correctly. The accounting firm could do this with excellent support from the team. Outbooks were brought to do all the back office compliance work to clear all the backlog and complete all the accounts with proper working papers.

We started with one of the most straightforward approaches to staying organised- using the standard format of excel to prepare schedules.

To avoid the challenges that come with manual entry, Outbooks started to provide links to each amount.

Outbooks made the client aware of the VAT threshold to avoid the risk of HMRC penalties.

Outbooks are also preparing personal tax returns for the directors so that tax payments would be paid on time to avoid late penalties.

Working papers prove that an effective, efficient, and economic audit has been carried out. We take a lot of care in preparing them and started to provide working papers for all detailed working and reconciliation.

All these measures helped the accounting firm save time from in-depth review and cross-checking of accounts, which is already supported with relevant documents and calculations. They are now able to concentrate on business growth.

With Outbooks, time spent on data entry and reconciliation went from weeks to days, freeing up time for them to engage with customers and work toward strategic goals.

Outsourcing works. You've got to do your research to find a trusted provider.

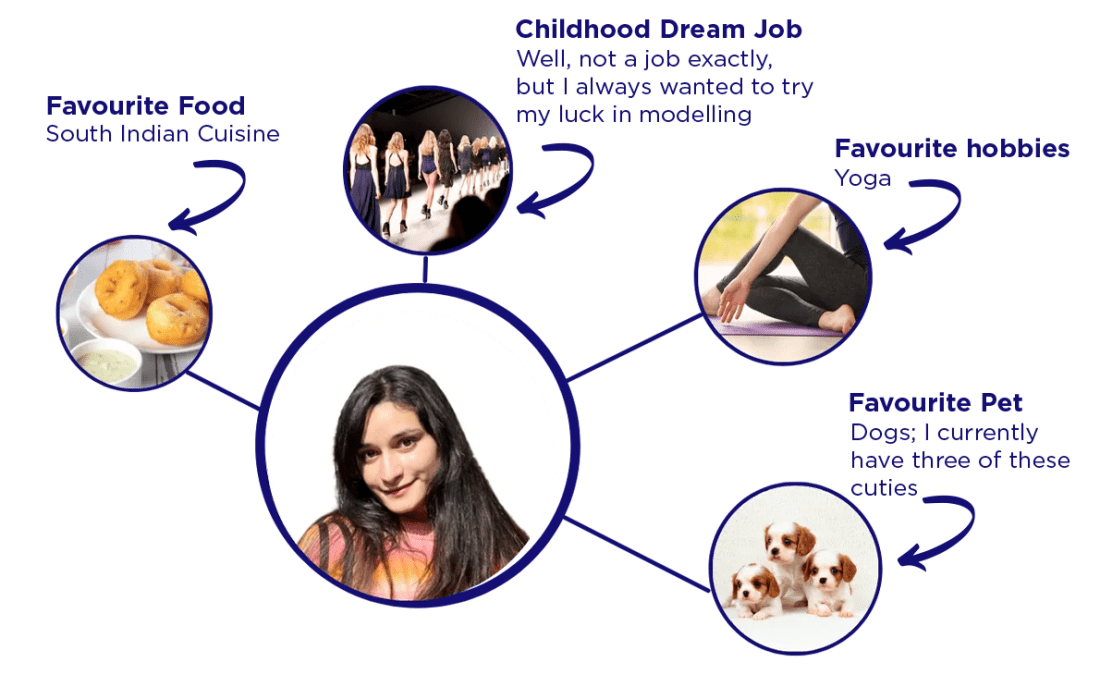

Nitu Gurawalia, Assistant Manager

What would you like to say to your leadership team?

I am happy to answer this question as I work under the best team; we support each other and share a solid interpersonal bond.

How has your career grown since you joined Outbooks?

I started as a fresher here, and I can see myself growing like anything, handling new clients, getting perks, and learning new things daily.

What would you say to someone considering a career with Outbooks?

If they are eager to learn and grow personally and professionally, they should join outbooks.

Where do you see yourself in the next four years?

Being a career-oriented girl, I keep myself open to learning and focused on my growth as an ACCA professional by taking away my

experience for broader development, already looking at my cabin with a nameplate in Black & Golden.

EVENTS 2023

Outbooks will be present at Accountex Sydney event in March 2023.

15-16 March

Video: Outsourcing Benefits

Guide: 9-step guide on using QuickBooks

Every business has heard about the wonders of Quickbooks. But for people unaware of its benefits, let us simplify it for you. QuickBooks is an intelligent accounting software that offers services ranging from payroll to bookkeeping. QuickBooks can help you run your business efficiently while giving you the tools to track how your business is doing at every step.

This blog is perfect for newbies looking for a definitive guide on getting started with QuickBooks. It will give you a 9-step guideline on using QuickBooks.

Step 1: Add Your Company's Information

Entering your company's information accurately is an essential step, as this information will appear on your invoices and sales forms that you send your customers. You can add this information by going to the accounts and setting menu and clicking on "company."

Add information like company name, business address, email address, website, phone number, etc. Make sure to enter the company type and the type of tax you want to file. You will also need to enter your Employer Identification Number (EIN) or Social Security Number at this stage.

Step 2: Fill in Your Fiscal Year Start Date

The next step is to designate your fiscal year. In accounts and settings, go to the advanced tab and click on accounting. QuickBooks needs to know when your business's fiscal year starts and ends. While doing this step, you can also select a date 12 months from now to indicate when you would like to "close your books" for that particular, fiscal year.

Step 3: Choose a Preferred Accounting Method

The next step is to determine whether your business will use cash or accrual methods for reporting income. If you need help deciding which method to use, consult an accountant who can help you understand the pros and cons of each technique. However, we would vote for the cash method, as it's easier for small businesses to handle.

Step 4: Choose Accounting Currency

After you choose a preferred accounting method, go to accounts and settings, click on advanced and select the currency of your choice.

Choosing multi-currencies can help you track different transactions, even in a foreign currency. Still, we suggest using this feature only if your customers or vendors are outside your home currency.

Step 5: Select the Company Logo

This step involves personalising your account; after all, the basic and essential tasks have been taken care of. Your company's logo will appear on invoices, sales receipts, and estimates. Make it as eye-catching as possible. Here are a few pointers on keeping your logo game strong:

- Upload a logo of a size less than 1MB

- Rectangular logos will stretch (use square logos)

- Use a white background for the logo

Step 6: Decide Your Company's Default "Net Payment" Invoice Terms

In accounts and settings, go to sales and then click on sales form content. Here you can set your default net payment invoice terms. This step is to help you prepare for sending your first-ever invoice from QuickBooks.

If you expect to be paid instantly, select "due on receipt" from the drop-down menu. However, you can also set a particular time frame or custom payment terms from the drop-down menu. Please note that the net payment terms you select in this step will become your default setting. However, you can always change these later.

Step 7: Set Up Sales

To accomplish this step, go to the left side menu, and click on the taxes slab. Obviously, if you sell a product, you need to collect sales tax.

After you click on the tax tab, you will be redirected to a set-up module. This module will ask you where you sell your products.

After completing this step, you can track how much you owe by looking at the sales tax liability report.

Step 8: You Can Track Your Inventory

After clicking on accounts and settings, go to sales. Select "track quantity on hand." The inventory set-up process is small and would take a minute or two. If you plan to track your inventory quantities in the future, it is best to set up the inventory feature from the beginning.

Step 9: Import Data And Sync Accounts

Import data to QuickBooks online by clicking on the gear icon at the top right corner of the screen. Click on "Import data" from the

drop-down menu. You can import the data of your suppliers, customers, products, and services.

In the final step, synchronise all the accounts you use to pay for your business expense or receive money with QuickBooks online. Click on bank accounts and add the account.

To Sum It Up

Why should you go for QBO rather than Xero: To start with, QBO has a lot of value to provide at a low price point. Especially for small businesses who would want a lot of features on a budget, QBO is a great choice. Additionally, you get access to advanced reporting. It also edges ahead of Xero with its depth and level of customization for dashboards including budgeting and forecasting and profitability analysis.

QuickBooks is an easy-to-use intelligent accounting software that any business can use for accounting, bookkeeping, or payroll-related work. If you need more assistance getting started with QuickBooks, you can always contact our experts.

Article: WHY should you use DEXT

Accounting is becoming digital day by day. In such conditions, businesses must have an optimisation solution that can convert physical receipts into digital ones. Dext is a software application that allows people to do that.

With Dext, you can electronically store bills, invoices, and receipts by clicking their pictures. It eliminates the hassle of manual entry of data. It uses optical recognition technology to separate information uploaded on a receipt or invoice and works its magic.

Here are a few advantages of using Dext:

- It helps keep you up to date as you do not have to do manual filing of data. You can upload data by clicking a picture of the receipt, invoice, or bill.

- Dext can help you save a lot of time. It’s a new-era digitalized tool to help you manage your work better.

- It helps go paperless. You no longer need to preserve all your paper receipts in one place and worry about their loss or misplacement.

Now that you know the benefits of using Dext, you must be curious to learn how to use it. Let’s look at the steps you can take while using Dext. You can use Dext through both your mobile phone and your desktop. Let’s take a look at using it through both options.

Steps to Use Dext Through a Browser

Login or Sign up

The very first step involves going to Dext and logging in. If you are new here, you can also explore their free trial. They also have a section explaining their products as well as pricing. We recommend you go through both to make your choice.

Add Documents

If you are using Dext on your computer or laptop, you need to have your invoices in PDF format. If you want to add a document (for example, a purchase invoice), click “+Add Document.”

Under this, there will be three options. These are ‘Costs’, ‘Sales’, and ‘Bank’. To capture a purchase invoice, select “Cost.”

You will now see 2 options, ‘One document per file’ and ‘One document per page.’ Add ‘one document per page if you have multiple files. Once you complete this step, select the files and let Dext do its magic.

You can add sales invoices and bank statements similarly. Click on ‘sales’ to add sales invoices and click on ‘bank’ to enter your bank statements. It’s easy as that!

Steps to Use Dext on Mobile Phone

Access the App on the Phone

Your bookkeeper or accountant can send you a link via text message, Simply click on the link and enter your password. This way, you will create your Dext account. In the next step, download the application and sign in to your account. You can now easily access Dext on your phone.

Submit Documents

Anytime you want to upload a sales receipt, a purchase invoice, or a bank statement, open the app and sign in using your email id and password. Go to the costs or sales inbox. You can upload a document now by clicking the green + button on the screen.

As soon as you click the green button, your camera application will open up. Dext offers different camera modes to capture all kinds of documents easily. These modes are:

- Single Mode: When you have only one document or one page to capture.

- Multiple Mode: When you have several documents that need to get uploaded.

- Combine Mode: When you have a lot of information that does not fit into one screen, Dext can use this mode to combine different pictures and use the information as one item.

Now, simply choose camera mode and click a picture of your document. While you review your document, it will show some “item detail.” Let’s see what all those are about.

- Category: This is where you can add the relevant tax code for this document.

- Owned by: This is the person submitting the document.

- Customer: If the invoice or receipt is for a particular customer, you can add their name or information here.

Your invoice is now “Ready.” In the final step, you can publish the invoice by sending it to your accounting software (Xero, QuickBooks, etc.)

Integrate Dext With an Accounting Software

Click “Connections” in the sidebar and scroll to “Integrations”. Find your accounting software in the list of available software and click on “Connect”. Press the “Connect Software Button” and “Finish” up the

set-up process. A few software that can be integrated with Dext are QBO, Xero, Nomisma etc.

To Sum It Up

Dext offers an intelligent way of accounting that allows more efficient workflows, 99% accurate data extraction, and a chance to build better client-relationship by being timely and compliant with your invoices and bills. Start using Dext today to become more productive and insightfu.