As an accounting practice founder, you know pricing your accounting services can be challenging. You want to make sure you're charging enough to cover your costs and make a profit, but you also don't want to price yourself out of the market or lose additional clients.

At Outbooks, we believe that an organisation requires new talent and fresh ideas to keep growing.

Have you heard about the downfall of Silicon Valley Bank? It's been a hot topic in the financial world lately, with many experts wondering if the bank could have avoided collapse by regularly forecasting its balance sheet.

Why do so many accountants struggle to price their services? An article by Amit Aggarwal

As an accounting practice founder, you know pricing your accounting services can be challenging. You want to make sure you're charging enough to cover your costs and make a profit, but you also don't want to price yourself out of the market or lose additional clients. This is a huge conundrum that all accountants face or, in fact, any small business faces

Then accountants also struggle to price their services for the following reasons:

- Lack of understanding of value: Accountants often have a deep understanding of the technical aspects of their work, but they may need a clearer understanding of the value their services provide to clients. As a result, they may need help to price their services appropriately.

- Lack of differentiation: Many accounting firms offer similar services, making it challenging to differentiate based on pricing. With a clear value proposition, accountants can set themselves apart from their competitors and command higher prices.

- Time-based billing: Some accountants still need to use time-based billing methods, making it challenging to price services accurately. This approach may not consider the value of the accountant's expertise, and it can create tension between the accountant and the client over the amount of time spent on a project.

- Need to understand the client's needs: Accountants may need to take the time to understand their clients unique needs and goals, making it challenging to price services appropriately. A one-size-fits-all approach to pricing may not be practical for clients with different needs and budgets.

To overcome these challenges, accountants can consider the following tips around pricing:

Consider the value - Accountants should focus on understanding their client's needs and their services' value. They should also differentiate themselves from their competitors and consider alternative pricing models that consider the value they provide rather than just the time spent on a project.

Consider your costs - What are your overhead costs, such as rent, utilities, and insurance? What are your variable costs, such as materials and supplies? Once you know your costs, you can start to calculate your prices. Think about your competition. What are other accounting firms in your area charging? What are their strengths and weaknesses? You want to ensure that your prices are competitive, but you also want to ensure that you're offering a quality service.

Be flexible - Feel free to adjust your prices as needed. If you need more business, you may need to lower your prices. You may need to raise your prices if you're getting too much business.

Now I also understand that the points mentioned above may only help some in pricing the services as the issues above are still theoretical. When the prospect comes and talks about the services they need, accountants need to be able to ask the right questions to ensure that the correct fee is being quoted.

To overcome the above issue, we have created a few pricing models which are accessible for everybody to use. They can be downloaded from here, or you can create your account here to start pricing your services effectively.

Amit Agarwal

Managing Director, UK

OUTBOOKS

Training & Growth

At Outbooks, we believe that an organisation requires new talent and fresh ideas to keep growing. To further our belief, we recruited 23 freshers who are CA interns or pursuing ACCA or are currently ACCA affiliates. We are confident that nurturing talent as always will continue to help us develop in this market.

Apart from that, we also welcomed seven trained accountants and 4 bookkeepers to our delivery team.

Learning never stops at Outbooks and we invested more than 9,000 hours last quarter on the training alone. Training is a big part of our culture to ensure we continually develop and promote our talent.

Our extensive bookkeeping and year-end training helps the organisation have new resources to utilise them optimally.

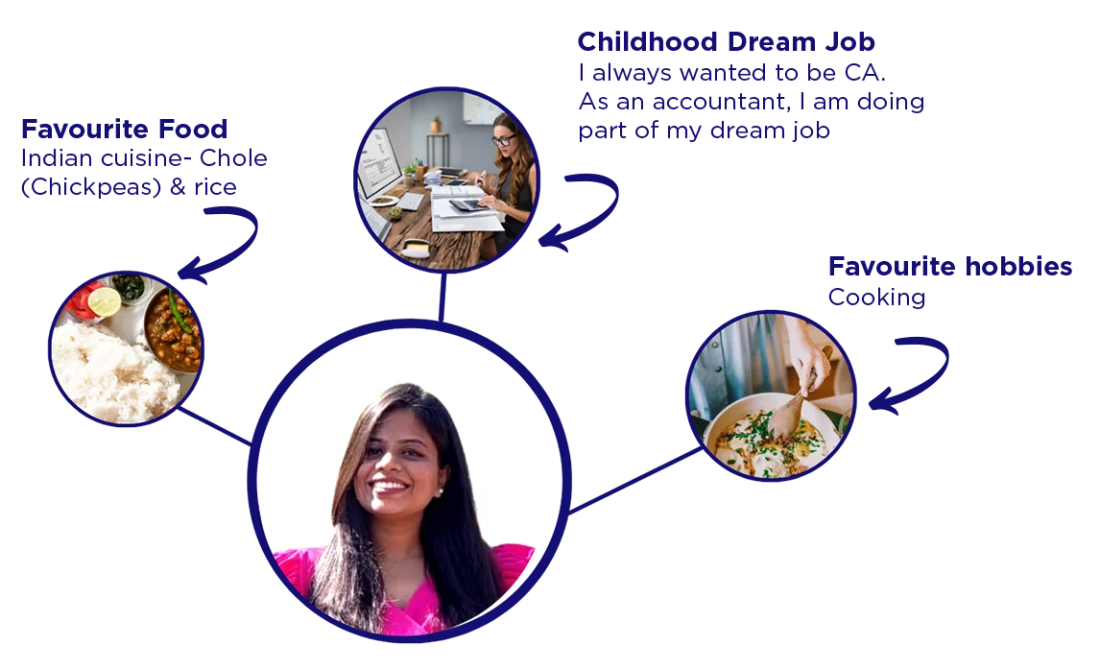

Employee Spotlight

Pooja Saraf,

Account Finalisation Executive

What are you most proud of during your journey with Outbooks?

Being able to manage a FTE client within few months of joining and able to give training to new joiners.

Where do you see yourself in the next four years?

I see myself to be somewhere in a managerial position. I would be able to handle more of team members and clients and directly contribute in the growth of the organisation.

What would you like to say to your leadership team?

Always be Grateful for whatever they have taught me in terms of working and also managing the work.

How has your career grown since you joined Outbooks?

Its been great I had joined as an account executive- processing and currently I am a I am handling one client & a team member and as a reviewer for another client.

What would you say to someone considering a career with Outbooks?

It would be a roller coaster ride from a learning perspective and if someone is a quick learner and does not have a laid back attitude. There would be number of opportunities to grow in terms of positions, handling client, handling a teams and etc.

Events & Updates

We were at Accountex Sydney.

We will be at Accountex London.

Stand No: 911

Could more regular periodic forecasting (with scenarios) of Balance Sheet have saved Silicon Valley Bank?

Have you heard about the downfall of Silicon Valley Bank? It's been a hot topic in the financial world lately, with many experts wondering if the bank could have avoided collapse by regularly forecasting its balance sheet.

While forecasting can help predict potential risks and prepare for the future, it's ultimately up to the bank to respond appropriately to those forecasts and manage their risks effectively.

We arrive at two scenarios in terms of what went down:

- They did not have periodic forecasting of their balance sheet

- They did not act on the periodic forecast that was done

It's also possible that they should have considered the potential impact of those forecasts. The collapse of Silicon Valley Bank has raised many questions about the regulatory system and its ability to detect financial distress before it becomes a crisis. Federal regulators need to get better at forecasting errors before they become crises, and to do so; they must update how they determine whether banks are in good standing.

Did We Know What Was Happening?

Many critics had raised their suspicions and red flags surrounding Silicon Valley Bank, including its rapid growth since the pandemic, its unusually high level of uninsured deposits, and its many investments in long-term government bonds and mortgage-backed securities, which tumbled in value as interest rates rose.

Despite these warning signs, federal regulators failed to take action to prevent the bank's collapse. The biggest question raised by the failure of Silicon Valley Bank is why didn't we see this coming.

The Federal Reserve faces criticism for missing what observers say were clear signs that the bank was at high risk of collapsing into the second-largest failure in U.S. history.

By all accounts, Silicon Valley Bank was an unusual bank. Its management took excessive risks by buying billions of dollars of mortgage-backed securities and Treasury bonds when interest rates were low. As the Fed continually raised interest rates to fight inflation, leading to higher rates on Treasurys, the value of Silicon Valley's bonds steadily lost value.

It was a mistake for Silicon Valley Bank to park its cash in long-term, low-yield bonds because of two facts that everyone knew:

- The Federal Reserve kept interest rates at such low levels they could only rise, which would drive down the resale value of those bonds.

- The U.S. government was pouring trillions into the economy, spurring inflation.

Predictably, the Fed would be forced to raise rates to shore up the dollar's value and cool inflation. This looming situation has been evident for years to those with common sense. Still, Silicon Valley Bank and the federal regulators who oversaw its balance sheet lacked that capacity.

The Way Forward

Based on what we understand, a possible way for banks to improve their risk management practices and avoid similar collapses could include making forecasting the balance sheet more critical. Some other steps that we think may help include:

- Establishing regular, periodic forecasting of the balance sheet, using a range of scenarios to identify potential risks and opportunities.

- Implementing robust risk management protocols and procedures for responding to forecasted risks, including contingency plans and risk mitigation strategies.

- Developing a risk management culture throughout the organisation, emphasising the importance of identifying and managing risks at all levels.

- Ensuring that senior management is held accountable for risk management practices and decision-making.

- Increasing regulatory oversight and enforcing stricter regulations ensure banks comply with risk management guidelines.

- Investing in training and education programs for employees to improve their skills and knowledge in risk management practices.

- Utilizing technology and data analytics to enhance forecasting and risk management capabilities.

To Sum It Up

The collapse of Silicon Valley Bank has highlighted the importance of effective risk management practices in the banking industry. While more regular periodic forecasting of the balance sheet can help identify potential risks and prepare for different scenarios, it is just one component of a comprehensive risk management strategy.

.png)