Small businesses often record healthy sales but still face pressure managing daily payments because accounts receivable remains unpaid for weeks or months. While invoices sit unpaid, expenses such as payroll, supplier payments and operational costs continue regardless of when customers pay.

Accounts receivable factoring solves this mismatch by converting unpaid invoices into immediate working capital, helping businesses improve cash flow without waiting 30-90 days for customer payments.

This guide explains:

- How factoring accounts receivable works in practice

- How accounts receivable factoring improves cash flow movement

- How factoring supports working capital

- How businesses use AR factoring for stable growth

How Accounts Receivable Affects Business Cash Flow?

Accounts receivable represents earned but uncollected revenue. A £10,000 invoice unpaid for 60 days creates cash flow gap funds can’t cover wages, inventory or growth despite recorded sales.

Factoring accounts receivable improves cash flow (cash movement) while strengthening working capital (current assets minus liabilities) by turning slow receivables into usable funds. As accounts receivable grows, operational cash shrinks, forcing supplier delays or lost orders. The core problem is not profitability; it is the delay between earning revenue and collecting cash.

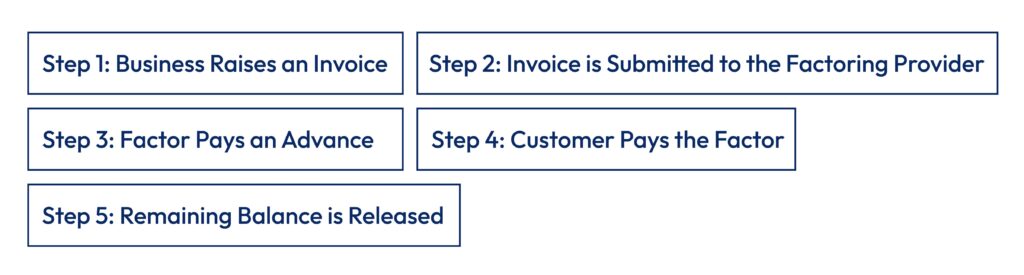

Step-by-Step Process of Factoring Accounts Receivable

Factoring accounts receivable follows a structured process that fits into normal billing systems.

- Step 1: Business Raises an Invoice: The customer receives an invoice with payment terms (e.g., 30 to 60 days).

- Step 2: Invoice is Submitted to the Factoring Provider: This is typically done through an online portal as part of the outsource accounts receivable management process.

- Step 3: Factor Pays an Advance: The provider pays an upfront amount (often a percentage of the invoice value). Types of factoring include factoring with recourse (business liable if customer defaults) vs non-recourse (factor takes risk, higher fees).

- Step 4: Customer Pays the Factor: Some arrangements are disclosed (customer pays the factor). Others may be confidential.

- Step 5: Remaining Balance is Released: Once payment is received, the remaining amount is paid to the business after fees.

Factoring Accounts Receivable Example

A simple invoice factoring example explains the financial impact:

| Item | Amount |

|---|---|

| Invoice Value | £10,000 |

| Advance (85%) | £8,500 |

| Customer Payment | £10,000 |

| Factoring Fee (2.5%) | £250 |

| Balance Released | £1,250 |

This factoring accounts receivable example shows how early funding improves cash availability and stabilises working capital.

Factoring Accounts Receivable Formula

A basic factoring accounts receivable formula explains the calculation:

Immediate Cash = Invoice Value × Advance Rate

Final Settlement = Invoice Value − Advance − Fees

These factoring accounts receivable formula highlights how receivables convert into cash through accounts receivable factoring.

How Factoring Improves Working Capital and Business Stability?

The main impact of accounts receivable factoring is seen in how working capital moves through the business.

1. Converts Receivables into Active Capital

Unpaid invoices are assets, but they cannot be used until collected. Factoring accounts receivable converts these assets into spendable funds, improving short-term liquidity.

2. Shortens the Cash Cycle

Without factoring, businesses may wait 60 to 90 days for payment. With accounts receivable factoring, this cycle is reduced to a few days. This strengthens factoring working capital management.

3. Improves Liquidity Without Borrowing

Since invoices are sold, not pledged, receivable financing factoring does not add liabilities. This helps maintain a healthy balance sheet.

4. Supports Sales Growth

With stable factoring cash flow, businesses can accept larger orders, invest in inventory and expand operations without waiting for payments.

5. Reduces Operational Stress

Reliable funding through factoring accounts receivable reduces payment delays, supplier issues and planning uncertainty.

Receivables Financing vs Factoring: Key Differences

While both options improve cash flow, they differ significantly in structure, control and disclosure, as outlined below.

| Aspect | Receivables Financing | Factoring |

|---|---|---|

| Ownership | Pledge as collateral | Sell outright (receivables purchase agreement vs factoring) |

| Collections | Business handles | Factor manages |

| Maturity Factoring | N/A | Pays on customer due date |

| Receivables Discounting vs Factoring | Loan-like, confidential | Often disclosed |

How Factoring Converts Receivables into Usable Funds?

AR factoring allows businesses to sell unpaid invoices to a financing provider in exchange for immediate cash.

This process is commonly known as AR factoring, factoring trade receivables or trade receivables factoring. The main purpose is to converts illiquid assets (unpaid invoices) into liquid working capital without creating debt on the balance sheet.

The mechanism differs from borrowing: instead of pledging receivables as collateral for a loan, businesses sell the invoice outright.

The factoring provider assumes collection responsibility, pays the advance immediately and releases the remaining balance (minus fees) once the customer pays.

This transforms the cash timeline from “wait 60 days” to “access funds in 2 days,” directly improving working capital availability.

Cost of Factoring Receivables and Cash Flow Impact

The cost of factoring receivables depends on several factors:

- Invoice volume

- Customer credit profile

- Dispute history

- Payment terms

- Service level

Typical charges range from 1% to 5%. Businesses should evaluate costs against improved factoring cash flow and reduced working capital pressure.

Role of Outsourced Accounts Receivable Services

Some providers combine factoring accounts receivable with outsourced accounts receivable services. These may include payment follow-ups, ledger maintenance, credit reviews and reporting.

For businesses facing collection delays, outsourced accounts receivable management strengthens internal controls alongside accounts receivable factoring.

Companies often compare models such as receivables financing vs factoring, receivables discounting vs factoring and receivables purchase agreement vs factoring before choosing the right structure.

Some arrangements also include factoring with recourse or maturity factoring depending on risk allocation.

Practical Considerations for Using Factoring

To gain maximum benefit from factoring accounts receivable, businesses should follow structured practices:

- Maintain accurate invoicing and documentation

- Monitor customer payment behaviour

- Review factoring fees regularly

- Avoid long-term over-dependence

- Integrate factoring into cash planning

These practices ensure accounts receivable factoring strengthens financial stability rather than masking internal weaknesses.

Conclusion

Factoring accounts receivable improves cash flow by converting unpaid invoices into immediate funds. More importantly, accounts receivable factoring improves working capital by keeping money in circulation instead of locked in accounts receivable.

Through consistent factoring of accounts receivable, businesses stabilise liquidity, support growth and reduce financial uncertainty. Outbooks Australia offers outsourced accounts receivable services that pair seamlessly with factoring handling collections, ledger management and credit control to maximise your cash flow gains. Speak to our team today for tailored outsourcing acconting services.

Need support with managing your receivables and cash flow? Call us at 0451320102 or email info@outbooks.com.au to speak with our team today.

FAQs

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.