Good books are what help you develop your accountancy business. They make a great difference. Things may not proceed as well as you wish otherwise. Bookkeeping outsourcing is what comes in then. Most businesses outsource their finances to be handled by in-house accountants. But it’s not always the most preferable option. In case you would like quality bookkeeping services, consider outsourcing to a qualified firm. Outsourcing bookkeeping in Australia can help save you money. It is relatively less expensive compared to an in-house bookkeeper. Many firms also choose to outsource accountancy solutions to ensure consistency, compliance, and smoother financial management across operations.

You don’t have to pay for additional office space. You don’t have to pay for training or for hiring employees. When you outsource, your bookkeeping is done by professionals. Outsourcing companies can also provide you with good financial advice. This enables you to make good business decisions. It means you can concentrate on other essential aspects of your business. If you’re an accountant with too much work, consider outsourcing.

Look for a professional outsourced accountant you can rely on to handle your bookkeeping with accuracy and expertise.

What is bookkeeping?

Bookkeeping is the systematic process of recording, organizing, and tracking all financial transactions of a business. It involves documenting every transaction related to income, expenses, sales, purchases and payments to maintain accurate and up-to-date financial records essential for business operations and decision-making.

Bookkeeping can be done using methods like single-entry or double-entry systems and may include tasks such as managing invoices, bank reconciliations, payroll and generating financial reports.

It serves as the foundational part of accounting, with bookkeepers recording the transactions before accountants prepare detailed financial statements like income statements and balance sheets. The primary purpose is to ensure financial accuracy and provide a clear view of the business’s financial health.

What is outsourcing bookkeeping?

Outsourcing bookkeeping means hiring an external service provider to handle your financial record-keeping tasks. These tasks typically include:

- Recording daily transactions

- Managing invoices and accounts payable/receivable

- Processing payroll

- Performing bank reconciliations

- Preparing financial statements and reports

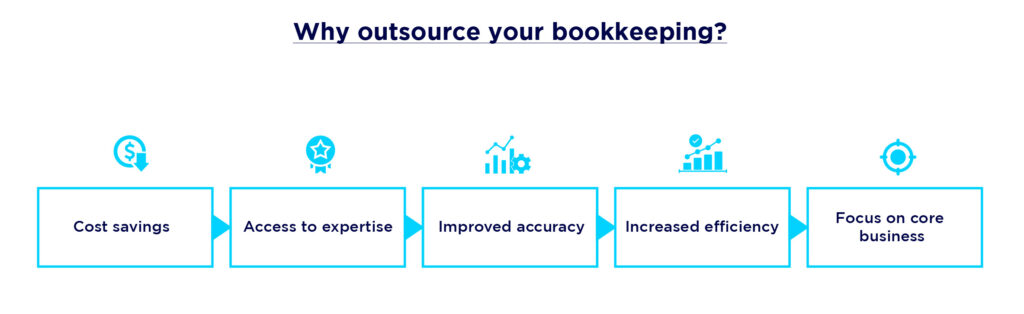

Why Businesses Prefer Outsourcing

Outsourcing replaces the need for an in-house bookkeeping team, offering multiple advantages:

- Cost Savings: No overhead costs for salaries, benefits, or office space

- Time Efficiency: Frees internal teams to focus on core business growth

- Expert Support: Access to trained and experienced bookkeeping professionals

- Accuracy & Compliance: Reduced errors and improved financial reliability

- Scalability: Services expand as your business grows

- Advanced Technology: Use of cloud-based accounting tools and automation

Security & Collaboration

With clear communication and defined expectations, your financial data is handled securely and efficiently by trusted professionals. Most outsourced service providers offer data protection, regular reporting, and transparent processes.

Outsourcing Bookkeeping in Australia

For Australian businesses, outsourcing is a cost-effective and flexible way to maintain accurate, up-to-date financial records. It also provides valuable financial insights to support smarter business decisions.

If you’re looking for a tailored approach, consider partnering with bookkeeping service providers in Australia that combine industry expertise, technology, and reliability.

What are the advantages of outsourcing bookkeeping?

Following are some advantages of bookkeeping outsourcing:

Expert knowledge and advice:

It’s nice to have good professionals, whether in-house or outsourced. But having bookkeeping in-house can be restrictive. There could be knowledge gaps. This can lead to issues down the line. You may then have to seek outside assistance. Outsourcing companies have professionals who are continually learning and updating themselves with new technology, often including accountants Brisbane local businesses trust.

Cost savings:

Cost is a major consideration for small businesses. Bookkeeping outsourcing can save you money. You don’t need to hire or train a bookkeeper. You don’t need to pay a salary. With in-house bookkeeping, you have all these costs. But with outsourcing, you only pay for the services you require.

Peace of mind:

You can dedicate your time to expanding your business. It will free up your time. You can spend time with your family or do your favorite thing.

Outsourcing reduces the risk of errors and missed deadlines, protecting your business from potential financial penalties and stress.

Latest technology:

When you outsource, you have access to new technology. Cloud technology allows you to view real-time information from anywhere. You can make important business decisions. Technology also facilitates it to have online meetings.

Outsourcing firms continuously upgrade their systems, providing you with access to the latest tools and automation that may otherwise be costly or complex to implement on your own.

Internal control:

This is significant in making a decision between in-house and outsourcing. With in-house bookkeeping, fraud is a possibility. Records may be incorrect sometimes. It’s too late when you realize.

With outsourcing, responsibilities are shared. There are two or more experts verifying records. This ensures records are examined with caution. It avoids issues.

Outsourcing introduces regular checks and balances, mitigating risks associated with fraud or accidental misstatements by having multiple professionals review the records.

Flexibility and scalability:

Outsourcing bookkeeping services can scale with your business growth or seasonal demands, allowing you to adjust the level of service as needed without the complexities of hiring or firing staff.

Ensure quality work:

You want the work done in a hurry. But you need quality as well. Outsourcing companies have professional staff. They would like to maintain long-term associations. So, they always strive to produce quality work.

Improved compliance and reporting:

Professional outsourcing providers ensure your financial records comply with regulatory standards and reporting requirements, helping you avoid costly penalties and maintain business credibility.

For scalable accuracy and peace of mind, switch to accounting and bookkeeping services that pair trained specialists with modern cloud workflows.

How bookkeeping outsourcing can help you?

- It decreases the chance of fraud.

- It’s the most cost-effective option.

- You receive better quality work and professional expertise.

- It assists you in saving time and earning more money.

How bookkeeping outsourcing services work?

Outsourcing can simplify your work and save you money. First, select a trustworthy company. Next, provide them with access to your financial records. Having clear expectations and effective communication is essential. This ensures your bookkeeping is well managed. You can then concentrate on developing your business. Outsourcing can make your financial management easy. The process of outsourcing finance and accounting services is straightforward.

Here’s how it’s done:

Key steps in bookkeeping outsourcing

1. Understand Bookkeeping Tasks:

- Bookkeeping involves monitoring payments and invoices.

- It entails expenses and tracking profits.

2. Select Either In-House or Outsourced Services:

- The in-house bookkeeper may prove costly.

- Outsourcing allows you to employ experts at a distance, for less funds.

3. Pick a Trustworthy Outsourcing Company:

- Research and find a reliable service.

- Chat with them online to talk about your requirements.

4. Provide Access to Financial Data:

- Provide documents such as bank statements

- Ensure they have all they require.

5. Establish Clear Expectations:

- Describe daily work and monthly reporting requirements.

- Talk about how frequently you will communicate.

6. Maintain Open Communication:

- Clearly define your goals for the bookkeeping process.

- Define the reporting format and the software they will use.

Additional insights on how outsourcing works in practice:

The workflow may vary slightly depending on the type of bookkeeping service you choose, an independent bookkeeper, a human-only service provider, or a hybrid (human + automation) solution. However, the general process usually involves the following steps:

- Setup of Accounting Software

The provider sets up or configures cloud-based software such as Xero, MYOB, or QuickBooks Online. - Connecting Financial Accounts

Business bank accounts, credit cards, and payment apps are securely connected to enable seamless data flow. - Automated Data Synchronization

Transactions are imported and updated automatically, reducing manual effort and errors. - Recording & Categorizing Transactions

Bookkeepers classify income, expenses, bills, and other entries to maintain clear and compliant records. - Bank Reconciliation

Transactions are matched with bank records to ensure accuracy and detect discrepancies early. - Financial Reporting

At the end of each month or reporting period, you receive accurate financial statements, including P&L, balance sheets, and cash flow reports.

Real-Time Access & Peace of Mind

With outsourced bookkeeping, you always have access to updated financial data without managing the daily workload yourself. The provider ensures accuracy, compliance, and timely reporting while you focus on running and growing your business.

Signs you need to outsource

Outsourcing can be a great assistance to your business. Here are some signs that you should consider it:

- Too Much Time on Bookkeeping: If you spend too much time dealing with finances, you need assistance. You ought to be operating your business.

- Outdated Financial Records: If your records are outdated, it leads to errors. Outsourcing can maintain accuracy in your records.

- Lack of Expertise: If you lack the appropriate expertise, outsourcing provides you with skilled individuals.

- Business Growth: As your business expands, your workload also increases. Outsourcing allows you to work on growth.

- Wanting to Save Costs: Outsourcing can be less costly for small businesses. You don’t have to employ full-time employees or invest in costly software.

Additional signs to consider:

- Growing Business Complexity: When your financial operations become more complex with new revenue streams or more transactions, outsourcing helps manage this increased workload effectively.

- Errors and Mistakes Increasing: Frequent bookkeeping errors that affect financial decisions or compliance indicate the need for expert help.

- Struggling to Meet Deadlines: Missing financial deadlines or having slow, inaccurate reporting are signs your current bookkeeping is overwhelmed.

- Internal Staff Overloaded: If your team is bogged down with bookkeeping and administrative tasks, outsourcing frees them to focus on higher-value work.

- Concerns About Compliance: Outsourcing can help you stay current with regulations and avoid costly penalties.

- Disorganized Financial Records: Messy or incomplete records hinder informed decision-making; outsourcing brings organization and accuracy.

- Ready for Growth and Scalability: Outsourcing offers flexibility to scale bookkeeping services with your business without the burden of hiring.

If any of these ring a bell, consider outsourcing your bookkeeping.

Things to think about when selecting a provider

If you outsource, make sure to select a trustworthy firm. They’ve pre-screened professionals. They can assist in the hiring process. Consider the following:

- Experience and expertise:

Search for a provider who has accounting and bookkeeping experience. They must comprehend your business requirements. Look for providers with experience in your specific industry for better understanding of your needs. - Security measures:

You’ll be sharing sensitive data. Ensure the provider has robust security. They must keep your data secure. Check for compliance with data protection regulations and use of encryption for data transfers and storage. - Services offered:

Various providers provide various services. Consider what you require. Identify a provider that fulfills those needs. Make sure the services align with your current and potential future needs for seamless expansion. - Scalability:

As your business expands, can the provider accommodate you? Ensure they can scale. Flexible contract terms and the ability to adjust service levels quickly are beneficial. - Time zone differences:

If your provider is in another time zone, communication may be an issue. Consider this when making your selection. Agree on overlap hours or set regular communication schedules to avoid delays. - Cultural fit:

They should mesh well with your team. They need to understand your company culture. Shared values and communication style improve collaboration and long-term partnerships. - Technology and software compatibility:

Check if the provider uses compatible or leading accounting software to ensure smooth integration with your own systems.

By keeping these factors in mind, you can select a partner that allows your business to thrive!

Conclusion

Outsourcing is a good option for your practice. It is usually more efficient and trustworthy than doing everything in-house. Some companies still like to have an in-house bookkeeper. But it’s your decision how you want to manage your business.

Develop your practice. Get new clients. Serve your clients’ needs and keep good relationships. Let an outsourced service manage your clients’ finances.

Spending Too Much Time on Books?

Let our experts handle your bookkeeping while you focus on what matters most—your business.

Book an expert ConsultationFAQs

What does it mean by bookkeeping outsourcing and why businesses should consider it?

Bookkeeping outsourcing involves the hiring of a third party either a firm or an individual who manages the financial books through which money is saved and you get access to experts advice.

What will be the cost of bookkeeping outsourcing in Australia?

The cost varies depending upon the type of service needed and complexity of the business. However, you can expect to save money compared to hiring a in-house accountant especially with online bookkeeping services in Australia.

Is outsource bookkeeping safe?

Definitely, if you go with a reputed and secure firm such as Outbooks as we use encrypted cloud based platforms for the security of financial data.

What are the benefits of outsourcing bookkeeping services in Australia?

Cost-effectiveness, reduced burden, freedom to completely focus on what you are best at, having expert advice and enhanced accuracy in financial data are the major benefits which outsourcing bookkeeping includes.

Can I do my own bookkeeping after learning it?

It is possible through online resources but it will be really time-consuming for you to just grab every single piece of knowledge related to it. Until and unless it is for simple and basic tasks but when it comes to complex situations you might stumble upon it.

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.