Cash flow management for startups determines business survival. According to the Australian Securities and Investments Commission (ASIC), 47% of failed Australian SMEs cite poor cash flow as a primary cause of insolvency.

Many profitable companies still fail because they run out of cash. Understanding the difference between profit and cash flow is crucial.

Cash flow tracks actual money movement. Profit shows accounting performance on paper, which can be misleading.

The Current Cash Flow Crisis in Australia

1. Startup Failure Rates due to Poor Financial Control

Research by CPA Australia shows that more than 60% of Australian startups fail within three years, often due to poor financial control and inadequate cash flow planning.

The Australian Small Business and Family Enterprise Ombudsman (ASBFEO) reports that over £26 billion is owed to Australian small businesses, with average payment times delayed by 6.3 days.

2. Late Payments and Small Business Risk

Late payment impact affects business survival significantly. Xero research confirms that 1 in 4 small businesses in Australia cite late payments as a significant threat to their survival.

Cash Flow Management for Startups & SMEs – Problems and Challenges

1. Startup Cash Flow Challenges

- Unpredictable revenue patterns

- Limited cash reserves for emergencies

- Longer customer acquisition cycles

- Poor burn rate and runway calculations

- Inefficient billing or payment processes

- Overreliance on a single or limited customers

- Poor financial planning and forecasting

- Declining or inconsistent sales

The Small Business Development Corporation (SBDC) highlights that many SMEs underestimate the time to profitability, often leading to cash flow problems and a failure to maintain sufficient startup runway.

2. SME Cash Flow Struggles

- Seasonal trading fluctuations

- Complex working capital management

- Growing inventory requirements

- Supplier payment timing issues

- Poor Financial Planning and Forecasting

- Insufficient Cash Reserves

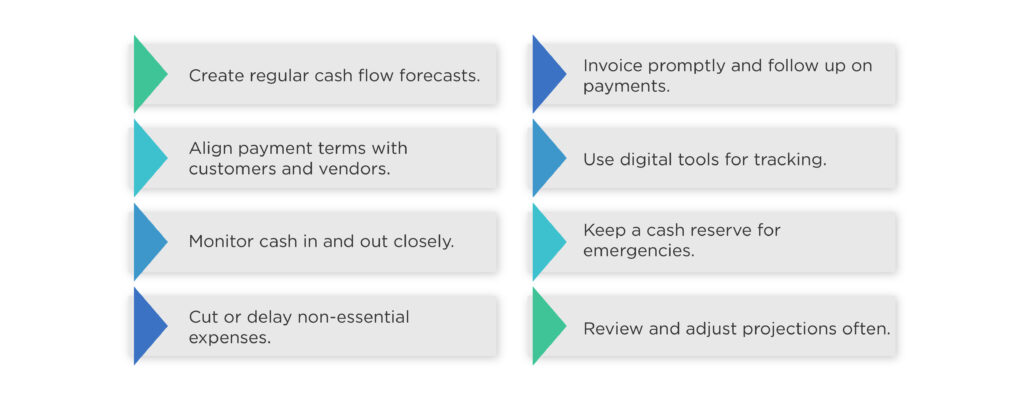

Essential Cash Flow Management strategies for Startups

1. Forecasting and Planning

Create monthly cash flow monitoring systems. These cash flow forecasts can be both long term and short term. Use 13-week rolling forecasts for better planning accuracy.

On the other hand short term cash flow forecasts (6-12months) are important for the daily ongoing activities. It helps to measure major expenses, seasonal cycles and opportunities to grow.

Cash flow forecast for SMEs provides essential business intelligence. Update projections weekly based on actual results.

Track the difference between inflow vs outflow carefully. This determines your actual cash position.

The Australian Government’s Business.gov.au recommends 13-week rolling forecasts for better accuracy in cash flow management for Australian SMEs.

2. Collection Improvements

Implement strong invoice collection strategies. Send invoices immediately after delivering goods or services.

Follow up on overdue accounts within 7 days. Offer 2% discounts for payments within 10 days.

Consider factoring services for immediate cash against outstanding invoices.

Digital accounting and billing platforms such as Xero, QuickBooks, and MYOB help automate invoicing, follow-ups, and reminders, leading to faster payments and improved collections.

Consider accounts receivable outsourcing to streamline your collections process. This approach can help improve cash flow by ensuring faster payments and reducing the burden on your internal team.

3. Scenario Planning and Stress Testing

Always develop best-case, worst-case, and base-case scenarios. Examine how expense, payment assumptions or revenue can impact your position. It will also contribute in enabling proactive adjustments rather than reactionary fixes.

4. Expense Management and Cost Control

- Maintain a process to review all the expenses and not only the major outflows. Monitor regularly expenses such as audit subscriptions, software costs, and minor expenditures.

- Keep your discretionary and non discretionary expenses separate. It will ultimately help you to easily spot and reduce the operational expenses.

5. Payment Terms Optimisation

- It is a better option to convince your suppliers for longer repayment terms and your customers for the shorter payment cycles. It will help you to broad your cash flow window and will help in maintaining liquidity.

- Standardise clear and firm payment terms in all customer contracts and invoices to minimise disputes or ambiguity.

Tools and Technology for Cash Flow Control

1. Digital Accounting and Automation Solutions

- Use expense tracking tools like QuickBooks, Xero, or Sage. These provide real-time cash position visibility.

- Cash flow solutions for small businesses include mobile apps. Monitor positions anywhere using smartphones.

- Automate invoicing and payment reminders. This reduces delays and improves collection efficiency.

- The MYOB Business Monitor reports growing adoption of digital tools by Australian SMEs, significantly improving tracking and reducing late payments.

2. Key Financial Metrics to Track

Track these financial health indicators:

- Operating cash flow ratio

- Cash conversion cycle

- Days sales outstanding

- Monthly cash burn rate

The Australian Tax Office (ATO) publishes DSO (Days Sales Outstanding) and other small business benchmarks by industry to help assess cash flow health.

Note: You should regularly benchmark your cash flow metrices including DSO, cash conversion cycle, and operating cash flow ratio. You may also utilise reports from government agencies to spot the areas that requires attention or improvement.

3. Leveraging AI and Advanced Analytics

Consider using AI-powered cash flow forecasting tools. These tools help with fraud detection and credit risk assessment. They will improve accuracy, efficiency, and security in cash flow management.

Translate AI signals into action, our management account services add narrative insights and next steps to your forecasts.

Building Financial Resilience

1. Emergency Planning

- Maintain cash reserves for emergencies equivalent to 3-6 months operating expenses. This provides crucial breathing space.

- Create multiple cash flow scenarios. Plan for best-case, worst-case, and most-likely outcomes.

- Develop contingency plans for different situations. Know exactly what to do when problems arise.

- According to the Reserve Bank of Australia (RBA), small businesses with 3-6 months of operating reserves fared significantly better during recent economic downturns.

2. Risk Management and Fraud Prevention

Working Capital Control

- Balance inventory levels with cash requirements. Don’t tie up excessive cash in stock.

- Negotiate better payment terms with customers and suppliers. Aim for faster receipts and slower payments.

- Review all expenses regularly. Cut non-essential spending during difficult periods.

Margin Improvement and Cost Optimisation

Review gross margins regularly and adjust prices or negotiate better supplier rates to improve profitability. Small margin improvements can significantly impact cash flow.

Smart Inventory Management Techniques

Use inventory management methods like just-in-time systems and regular audits to avoid excess stock. Apply digital tracking tools to identify slow-moving items and optimise reordering, freeing up cash for other business needs.

Common Mistakes to Avoid

1. Cash Gaps in Startups and SMEs

- Don’t underestimate time needed to achieve profitability. Most businesses take longer than expected.

- Avoid over-optimistic sales projections. Base forecasts on realistic market research and industry data.

- Ensure adequate funding for at least 12 months. Many startups fail because they lack sufficient working capital.

2. Revenue vs Profitability Confusion

- Remember that profitable businesses can still have cash flow problems. Timing differences create this situation.

- Monitor actual cash receipts, not just sales figures. Outstanding invoices don’t pay bills.

- Track payment patterns carefully. Some customers consistently pay late despite good intentions.

Industry-Specific Cash Flow Solutions

| Industry | Key Challenge | Cash Flow Solution |

|---|---|---|

| Retail | Seasonal fluctuations | Plan cash reserves for quiet periods |

| Manufacturing | Long production cycles | Negotiate extended supplier terms |

| Services | Project-based income | Use milestone billing systems |

| E-commerce | Rapid growth strain | Monitor working capital closely |

IBISWorld Australia provides cash flow indicators, working capital requirements, and risk levels across major industries.

Prudent Debt and Financing Strategies

- Manage short-term and long-term debts carefully. Prioritise high-interest debt repayments, review financing arrangements regularly, and use business credit cards strategically for operational flexibility.

- Consider refinancing options when interest rates change.

Quick Cash Flow Checklist

Weekly Essentials

- Monitor bank balances daily

- Update cash flow forecasts

- Follow up overdue invoices

- Review upcoming payments

Monthly Reviews

- Analyse cash conversion cycle

- Compare actual vs forecast results

- Review supplier payment terms

- Assess emergency fund levels

Note: Train your team to quickly adapt forecasts and budgets based on new market information or business changes. Quick plan revisions can prevent cash flow problems and ensure success.

Practical Budgeting and Cash Control Tips for SMEs

Smart Budgeting for SMEs

- Create realistic budgets based on historical data. Include seasonal variations in planning.

- Implement systematic cost control measures. Regular expense reviews identify unnecessary spending.

- Use separate accounts for different purposes. Ring-fence funds for obligations, emergencies, and growth.

Regular Subscription and Expense Audit

Conduct regular audits of all recurring expenses and subscriptions, including software, cloud services, and memberships. These smaller costs can accumulate and impact cash flow over time.

Integrated Technology Stack

- Connect sales, inventory, and accounting systems. Integrated platforms improve forecasting accuracy.

- Use automated payment systems where possible. Direct debits ensure regular income collection.

- Consider invoice factoring for immediate cash. This solution helps manage working capital gaps.

Emergency action plan for Cash Flow problems

When cash flow problems develop:

Immediate Actions

- Contact major customers about outstanding invoices

- Negotiate extended payment terms with suppliers

- Review all discretionary spending

Short-term Solutions

- Arrange temporary overdraft facilities

- Consider invoice factoring

- Sell excess inventory quickly

Long-term Planning

- Improve credit control procedures

- Diversify customer base

- Build stronger cash reserves

Consider Professional Support

Seek help early when cash flow problems develop. Waiting too long limits available options.

Support Channels for Australian SMEs:

- Business accountants and advisors

- Bank relationship managers

- Government support schemes

- Specialist finance providers

The Australian Government provides schemes such as the Boosting Cash Flow for Employers and Export Market Development Grant (EMDG). Visit business.gov.au for a full list.

Frequently Asked Questions (FAQs)

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.