Ever hit “send” on an invoice and then watch payment stall over small errors?

After meeting every deadline and delivering great work, it’s time to submit the invoice and get paid. The funds are already earmarked for new laptops, an office refresh, or even a family vacation.

Then comes the email: “We can’t process the payment due to some issues…” You fix the invoice and resubmit only to realise it’s Friday, so payment waits until Monday.

Invoicing may seem simple, but with multiple clients it becomes a long process where mistakes trigger delays and harm professional reputation.

This guide explains invoices for businesses, what to put on an invoice and invoice description essentials so approvals move faster. It also covers invoicing process best practices and invoice best practices, including how to handle invoices, how to manage invoices and how to raise invoice for payment without back-and-forth. For clarity, we unpack “invoice for services rendered” meaning and provide practical examples of a clear description invoice or invoice description that reduces disputes.

Finally, for small firms, we compare invoicing systems for small businesses and how to choose an invoicing system for small business that automates reminders and speeds cash flow; so “invoice out” leads to on‑time payments, not weekend waits.

What is an invoice?

An invoice is a formal, itemised document a seller issues to a buyer to request payment for specific goods or services, detailing what was provided, how much is owed and when and how payment should be made. If you’re learning how to make an invoice or how to create an invoice, this is your foundation.

What is the Purpose of Invoice?

Serves as a request for payment and a legal record of the transaction, supporting accounting, audits and tax compliance.

Helps manage cash flow by setting payment terms (e.g., Net 7/14/30) and clarifying late fees or early-payment discounts

What are invoices used for?

Invoices are used to request and collect payment, document sales, support bookkeeping and taxes and provide legal and operational transparency across the buyer seller relationship.

1. Main Purpose

Establish a customer’s obligation to pay by detailing what was delivered, how much is owed and the payment deadline and method, enabling predictable cash flow and collections workflows.

Create an official record of the transaction that both parties can reference for reconciliation, controls and audits over time.

2. Payment and cash flow

Serve as formal payment requests with clear terms (e.g., Net 30), facilitating dunning, AR aging and faster settlement via accurate remittance details and identifiers (invoice number, PO).

Improve liquidity by standardizing timely issuance, follow‑ups and late‑fee policies, which reduce days sales outstanding (DSO) and write‑offs.

3. Bookkeeping and reporting

Feed accounting systems like Bookkeeping, Payroll, accounts payable, accounts receivable, data entry and management accounting with itemized, dated sales data used to prepare financial statements, track profitability and monitor performance trends and seasonality.

Provide a reliable audit trail linking quantities, prices, taxes and terms, aiding error detection and dispute resolution at period close.

4. Tax compliance

Document taxable amounts, rates and registration details required for GST/VAT and income‑tax filings and substantiate input/output tax claims for buyers and sellers.

Support regulatory record‑keeping requirements and facilitate audits with standardized, complete transaction evidence.

5. Legal protection

Evidence of the agreed scope, price and terms; accepted or signed invoices can be enforceable and help resolve payment disagreements or service disputes.

6. Operational insights

Enable sales analytics (product mix, peak periods, buyer behavior) that inform pricing, inventory planning and marketing strategy.

Tie sales to stock movements for replenishment forecasting and inventory control in product businesses.

7. Process integration

Anchor 2‑/3‑way matching with purchase orders and goods receipts in AP/AR, reducing errors and accelerating approvals and payments.

Support automation and e‑invoicing to cut processing costs, minimize errors and speed settlement across digital rails and integrated ERPs.

What Are the Different Types of Invoices for Businesses?

- Standard invoice – Flexible bill showing seller/client details, unique invoice number, items/services and amount due.

- Credit invoice – Provides refunds/discounts (negative totals).

- Debit invoice – Increases amount owed (positive totals).

- Mixed invoice – Combines credit/debit adjustments.

- Commercial invoice – For cross‑border shipments with customs details.

- Timesheet invoice – Converts tracked hours into billable items.

- Expense report – Reimburses employee business expenses.

- Pro forma invoice – Pre‑work estimate for budgeting.

- Interim invoice – Progress billing for long projects.

- Final invoice – Complete settlement at project end.

- Past‑due invoice – Reissued with late fees.

- Recurring invoice – Automates periodic billing.

- E‑invoice – Electronic format for faster processing.

- Purchase invoice – Buyer’s proof of purchase.

- Sales invoice – Seller’s official payment request.

For Australian businesses, an ABN invoice template ensures compliance across all these types.

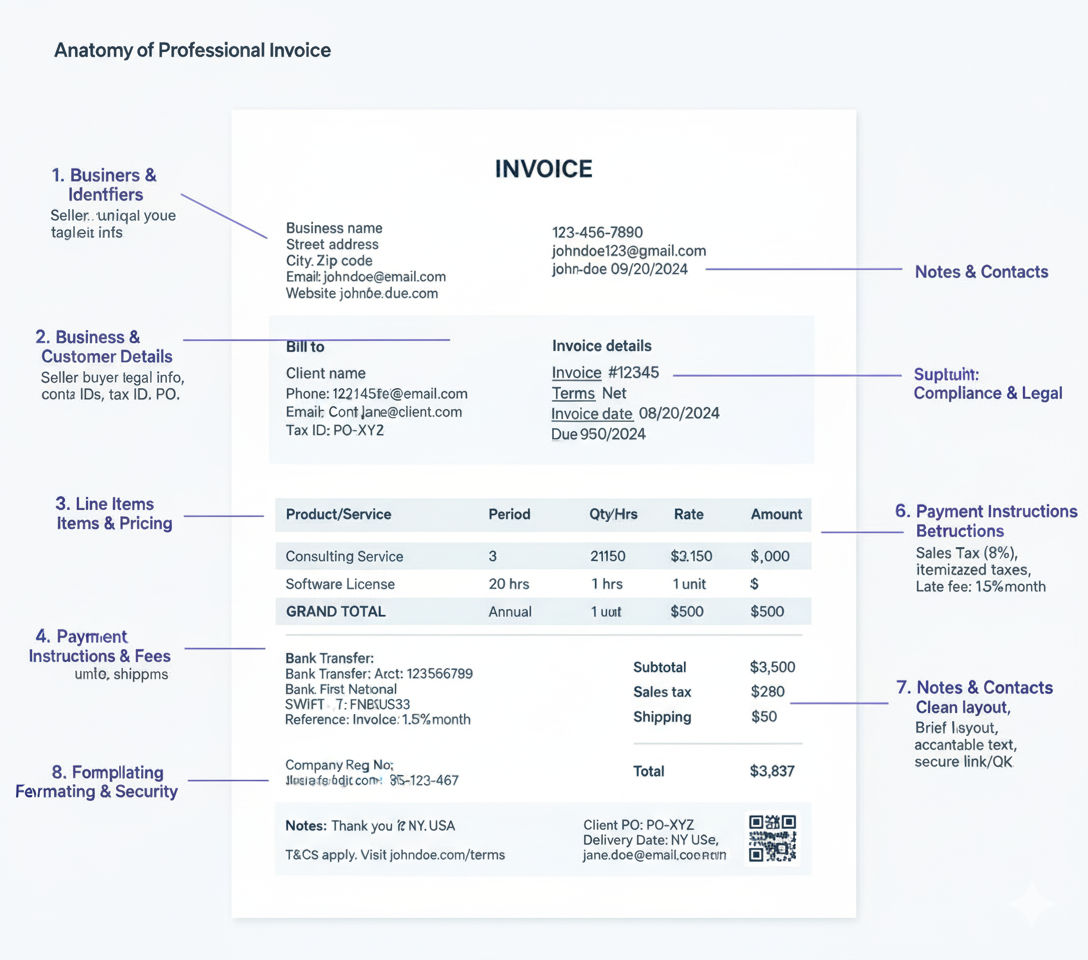

What to Include on an Invoice: Essential Fields and Best Practices for Small Businesses

Wondering what to put on an invoice? Here’s exactly what every invoice needs for fast approvals.

An invoice should clearly identify the transaction, the parties, what was delivered, how much is owed, when and how to pay and all tax/compliance details required in the jurisdiction.

1. Header and identifiers

Make “Invoice” prominent at the top, followed by a unique invoice number, the issue date and a clear due date; this prevents AP routing delays and anchors payment terms for cash‑flow tracking.

If correcting or adjusting, label clearly as “Credit Note,” “Debit Note,” or “Revised Invoice,” and cross‑reference the original invoice to maintain a clean audit trail.

2. Business and customer details

Include the seller’s legal name, trading name (if different), registered address, phone, billing email, website and tax IDs (GST/VAT/ABN, etc.) to meet compliance and vendor‑onboarding checks.

Mirror the buyer’s legal entity name, billing address, AP contact and (if required) tax ID, department/cost center and ship‑to address to avoid PO mismatches and approval delays.

3. Line items and pricing

Itemize products/services with clear descriptions, delivery/service dates or billing period, unit of measure (hours, units, licenses), quantity, unit price/rate and per‑line total for transparent validation.

Include per‑line discounts or adjustments and reference SKUs, milestones, SOW/contract IDs, or timesheet IDs to reduce disputes and speed matching.

4. Subtotals, taxes, fees and currency

Show a subtotal before taxes/fees, then break out taxes by type and jurisdiction (e.g., GST/VAT/CGST/SGST/IGST), with rates, taxable base and your tax registration number; annotate zero‑rated/exempt lines where needed.

List shipping, insurance, handling, customs/brokerage and other charges with taxability clearly indicated; display the grand total with ISO currency code and (for multi‑currency) the agreed FX rate/date.

5. Payment instructions and terms

Provide accepted methods (bank transfer with beneficiary, bank, account/IBAN, SWIFT; ACH/SEPA/UPI; card; secure payment link/QR) and precise remittance references (invoice and PO numbers) for fast reconciliation.

State terms such as Net 7/14/30, early‑payment discounts (e.g., 2/10 Net 30), late fees/interest, deposit/retainer rules and partial‑payment policies to shape timely settlement behavior.

6. Controls, compliance and legal

Include the purchaser’s PO number for 2‑/3‑way matching, delivery/acceptance references (GRN, delivery note, acceptance certificate) and service period/supply date to align with approvals and revenue recognition.

Add place of supply, reverse‑charge notes, e‑invoicing identifiers (e.g., IRN/QR where applicable), company registration numbers and any required statutory disclosures; link or attach full T&Cs, returns/warranty and dispute window.

7. Notes, contacts and attachments

Use a brief notes section for relevant reminders (e.g., “Include invoice no. in payment reference”), holiday schedules, or courteous messages without clutter.

Provide a direct AR contact (name, email, phone) and attach supporting evidence like timesheets, delivery notes, expense receipts, or milestone sign‑offs to minimize back‑and‑forth.

8. Formatting, versioning and security

Keep a clean, readable layout with a well‑structured items table and selectable text (PDF/structured e‑invoice) to enable straight‑through AP processing.

If reissuing, label versions clearly and maintain an internal change log; send tamper‑evident files or trusted e‑invoicing formats and use secure, branded payment links.

Want faster collections, cleaner audits and fewer disputes? Explore our accounts payable process to standardise invoicing, automate PO/GRN matching and accelerate on‑time payments with clear terms and identifiers.

Copy‑ready checklist

- Invoice title; unique number; issue date; due date

- Seller legal/trading name; address; contacts; tax and company IDs

- Buyer legal name; billing address; AP contact; tax ID; PO/cost center

- Item descriptions; dates/period; UoM; quantity; unit price; line totals; line discounts

- Subtotal (pre‑tax); tax type/rate/amount and registration; zero/exempt notes

- Shipping/handling/other charges; grand total with currency and FX reference

- Payment methods and full bank/wallet details; remittance reference format

- Terms: Net, early‑pay discount, late fee/interest, deposit/partial‑payment rules

- PO number; contract/SOW/milestone and delivery/acceptance references

- Compliance: place of supply, reverse charge, e‑invoice fields; T&Cs/returns/disputes

- AR contact details; concise notes; supporting attachments

Invoice Best Practices: How to Write an Invoice That Gets Paid Faster for Small Businesses

Here are some best practices that can help make your invoicing process more efficient:

1. Establish clear communication

When you onboard a new client, it’s important to communicate clearly about key details. This sets the right expectations and helps avoid confusion later.

Discuss your rates, explain additional fees, set invoice frequency, share preferred payment methods, and confirm basic company details that appear on the invoice.

Clear communication shows professionalism. It makes it easier for clients to pay you without unnecessary back-and-forth. When clients know what to expect, they are more likely to pay on time.

2. Format your invoice simply

When how to write an invoice, clarity is key. Your clients care most about a few important details:

Make sure these elements stand out so that clients can easily find them without spending too much time searching.

To ensure maximum readability, follow these simple formatting tips:

- Use one font: Stick to a single font throughout your invoice. Sans-serif fonts are recommended because they are easier to read in business documents.

- Highlight key information: Use bold or italics for important details like pricing, the invoice date and your banking information. This draws attention to the most critical parts of the invoice.

- Create clear tables: If you include a table for services and pricing, make sure it has enough space between items. Avoid cramming too much information into a single column.

- Organise layout: Since people typically read from left to right, place key information, such as charges, on the right side of the invoice. This makes it easier for clients to see what they owe.

- Use simple language: Choose easy words that are simple to read and understand. To check if your wording is clear, read it out loud.

- Avoid extra information: Keep your invoice focused on essential details. Don’t overload it with unnecessary information like company history or promotional messages, as this can distract from the main purpose of the invoice.

By formatting your invoices simply and clearly, you enhance readability and make it easier for clients to process payments promptly. This professionalism helps build trust and encourages timely payment for your services.

3. Send invoices on time

Money is a sensitive topic for any business. Sending accurate invoices on time helps your clients manage their finances better. For example, if your client processes all invoices mid-week, receiving yours on schedule allows them to handle everything efficiently at once.

If you miss the deadline and submit your invoice late, it creates extra work for your client. They may have to manage your payment separately from others, which can disrupt their workflow. While this might seem like a small issue, consistently missing invoice deadlines can damage the trust your client has in you.

By sending invoices on time, you strengthen your client relationships and improve your chances of getting repeat business.

4. Consider invoice automation software

As your business grows and you take on more clients, managing invoices can quickly become overwhelming. Imagine having over 25 clients and needing to fill out invoices for each one regularly. Each client may have different payment deadlines and time zones, making it difficult to keep track of everything.

Human errors are also a risk in manual invoicing. Clients might receive incorrect or misplaced invoices, leading to confusion and delays in payment.

Invoice automation software can simplify the invoicing process significantly. These tools allow you to automate many aspects of invoice creation. For instance, you can schedule invoices based on each client’s specific deadlines and track unpaid invoices from a central dashboard.

Some common features of invoice automation software include:

- Recurring invoices: Automatically send invoices to regular clients at set intervals.

- Multilingual invoices: Create invoices in different languages for international clients.

- Quote conversion: Easily convert quotes into invoices.

- Custom branding: Add client company logos to their invoices for a personalized touch.

- Multiple templates: Use various invoicing templates to meet different client needs.

If you only manage a few clients, manual invoicing might be manageable. However, as your business expands, using invoice automation software can save you significant time and reduce the likelihood of errors.

5. Information every invoice must have

Every invoice, regardless of the industry, should include certain key elements. These elements ensure clarity and help with organisation.

First, the word “Invoice” should be clearly stated at the top. This makes it easy for clients to recognise the document and helps them file it correctly in their financial records.

Here are the essential details every invoice must have:

- Invoice number: Each invoice should have a unique number. This helps you and your client track payments easily.

- Invoice issue and due date: Clearly state when the invoice was issued and when payment is due. This helps avoid confusion about deadlines.

- Client company’s address: Include the full address of the client’s business. This ensures that the invoice reaches the right place.

- Your business’s address: Your own business address should also be included. This provides clients with your contact information.

- Your rates: Clearly list your rates for services or products provided. This transparency helps clients understand what they are paying for.

- Client company’s business name: Make sure to include the official name of the client’s business on the invoice.

- Your business name: Your business name should be prominently displayed so clients know who issued the invoice.

- Client company’s logo: Including the client’s logo can make the invoice look more professional and personalized.

- Payment terms: Clearly outline your payment terms, including any late fees or discounts for early payment. This sets clear expectations for payment.

While these details may seem basic, many people forget to include them, leading to delays in payment. Using templates or invoicing software can help ensure that all necessary information is included automatically for each client.

The last thing you want is to have your invoice sent back due to simple errors or missing information. By including all these key elements, you can streamline your invoicing process and reduce potential issues with payments.

6. Keep track of late or unpaid invoices

According to a 2024 survey, small business owners in Australia lose between $12,000 and $30,000 each year due to late payments. This loss can significantly impact your business’s cash flow and overall financial health.

It’s important to understand that letting unpaid invoices slide can add up quickly. If you ignore these dues, your hard work may end up feeling like charity.

There is nothing wrong with following up on unpaid invoices. Often, clients misplace invoices or forget to pay due to their busy schedules. Relying on clients to notice and contact you about unpaid invoices is not a realistic approach.

To manage this issue effectively, keep track of your unpaid invoices. You can do this manually using Excel or by utilising invoice automation software. Regularly reviewing your accounts receivable will help you stay on top of payments and ensure that you follow up promptly when necessary.

6 Tips for streamlining invoicing in professional services

In addition to best practices, here are some quick tips to help you streamlining your invoicing process:

1. Notify your client after submitting your invoice

Notifying your client after you submit an invoice is crucial, especially if they are a first-time client or if the invoice amount is significant. Clients may not always check their email regularly. They might also be busy or unavailable to see your invoice in their accounting software.

In these cases, it’s helpful to reach out personally. Use professional communication channels like Slack, Discord, or other messaging platforms that respect their personal space. This approach ensures that your invoice gets acknowledged and shows that you are proactive about your work.

A simple message can go a long way. You can say something like, “Hi [Client’s Name], I just sent you the invoice for [service provided]. Please let me know if you have any questions.” This not only confirms receipt but also opens the door for any discussions about the invoice. By taking this extra step, you help ensure timely payment and maintain a good relationship with your client.

2. Always cross-check your banking details

Getting paid is the main purpose of your invoice. If your banking details are incorrect, clients won’t be able to pay you. This can lead to delays and frustration for both you and your clients.

To avoid this issue, always cross-check your banking information before sending out an invoice. Make sure that your account number, bank name and payment method are all accurate.

If you have recently changed your bank or payment method, it’s even more important to verify these details. Inform your clients about any changes to ensure they have the correct information. This proactive step helps prevent payment issues and keeps the invoicing process smooth. By taking the time to double-check your banking details, you can ensure timely payments and maintain a good relationship with your clients.

3. Set clear overcharging expectations

Client needs can change frequently. As business conditions improve, you may find yourself taking on more work than initially discussed. For accountants, this might mean additional tasks like extra financial reports or bookkeeping services that go beyond the original agreement.

At first, these requests may seem small and you might be willing to handle them without charging extra. However, as these “small” tasks accumulate, they can take up significant time and resources.

One effective way to set clear expectations is to offer your services in packages. For example:

- Basic package: Monthly bookkeeping for up to 50 transactions, one financial statement and additional transactions at $1 each.

- Standard package: Monthly bookkeeping for up to 100 transactions, two financial statements and additional transactions at $0.75 each.

- Premium package: Monthly bookkeeping for unlimited transactions, quarterly financial statements and additional reports at $50 each.

Make sure to clearly mention any extra charges in your invoices. You can include them in a separate line item or highlight them in a designated section.

4. Document & backup your invoices

It is essential to create a backup of your invoices before submitting them. This practice can benefit your business in several important ways.

First, having a backup helps you avoid legal troubles in the future. If a client disputes a charge or claims they never received an invoice, you will have proof of the transaction. This can protect your business and provide clarity in case of any disagreements.

Second, backups help you manage and track your finances more effectively. By keeping records of all invoices, you can easily see what has been paid and what is still outstanding. This information is crucial for maintaining a healthy cash flow.

Finally, maintaining a history of client transactions is valuable for future reference. It helps you understand your relationship with each client and track their payment habits over time. This information can inform your business decisions and improve client management.

5. Choose the correct invoice type

If your business offers various services, it’s important to use different invoice types for each one. This helps clients understand what they are paying for and makes the invoicing process clearer.

For instance, if you provide content writing services, your invoice should focus on key details like word count and any revisions made. On the other hand, if you offer video editing services, your invoice should highlight hours worked and specific edits requested by the client.

6. Add a thank you note

Including a “thank you” note in your invoice is a simple yet effective practice. Most clients may not notice when you add this note, but they will likely notice if it’s missing. A thank you note adds a professional touch to your communication.

If you want to build a long-term relationship with your client, expressing gratitude shows that you value their business. A simple one-liner can be enough, such as: “Thank you for your business; we appreciate your trust and collaboration.”

Make sure the thank-you note is brief and does not take up much space on the invoice.

Conclusion

Making your invoicing process easier is crucial for receiving payments on time and maintaining strong relationships with clients. An efficient invoicing system helps ensure that clients understand their obligations and feel confident in your professionalism.

By following these best practices, you can reduce mistakes in your invoices. A well‑organised invoice not only looks more professional but also helps clients process payments quickly. Clear communication about payment terms and expectations can prevent misunderstandings that lead to delays.

Remember, effective invoicing is essential for the success of your business. It contributes to steady cash flow and fosters trust with your clients, which is vital for long-term partnerships.

Struggling with invoicing delays? Outsource your accounts receivable service to Outbooks for faster payments – contact us at info@outbooks.com.au or 0451320102 for faster payments today!

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.