Are you struggling to keep track of your outsourced bookkeeping services and worried about errors or missed deadlines that could jeopardise your business? Many Australian small businesses turn to outsource bookkeeping solutions to save time and benefit from expert accounting and bookkeeping services.

However, even with the best bookkeeping outsourcing company, the responsibility for accurate record-keeping and compliance remains with you. Ensuring proper monitoring of your outsourced accounting and bookkeeping is essential to avoid costly penalties, cash flow problems and maintain good bookkeeping practices.

In this blog, you’ll discover how to effectively monitor your bookkeeping in Australia and ensure accuracy across your financial operations. We’ll cover:

- Key benefits of outsourcing bookkeeping, including improved accuracy and efficiency for small businesses.

- Clear steps for setting agreements and expectations with your bookkeeping outsourcing company and other outsourced accounting companies to ensure transparent partnerships.

- Methods for preventive controls and oversight in accounting and bookkeeping services to minimise errors and fraud.

- How to leverage QuickBooks, outsourced Xero bookkeeping and top bookkeeping software for streamlined monitoring.

- Tips to efficiently manage offshore outsourcing bookkeeping, focusing on communication and data security.

- Warning signs and quick-response strategies for common performance issues in outsourced bookkeeping.

- Best practices for maintaining productive relationships and regular feedback with your outsourcing provider.

Monitoring ensures businesses meet Australian expectations for record keeping and reporting deadlines, supporting better operational control and helping avoid common outsourcing pitfalls.

Why Monitoring Outsourced Bookkeeping is Necessary

Accurate monitoring of outsourced bookkeeping is essential because business owners remain responsible for the completeness and accuracy of their financial records, even when outsourcing bookkeeping tasks. Partnering with professional bookkeeping outsourcing companies improves accuracy and operational efficiency but does not eliminate the need for oversight and internal controls.

Poor supervision of outsourced bookkeeping can lead to serious consequences such as errors, omissions and delayed processing of financial tasks. These issues may result in compliance risks and disruption to timely financial management, which can impact decision-making and cash flow stability.

Risks of Inadequate Monitoring

The main risks associated with poorly monitored outsourced bookkeeping include:

- Inaccurate or incomplete financial records that reduce business transparency.

- Missed deadlines for financial activities such as bank reconciliations, payroll processing and report submissions.

- Reduced ability to detect discrepancies, errors, or fraud in a timely manner.

- Potential harm to the business’s reputation and operational flow due to ineffective cash flow management.

Benefits of Effective Monitoring

Consistent monitoring of outsourced bookkeeping benefits businesses by ensuring:

- Timely, accurate and reliable financial data that informs clear decision-making.

- Enhanced financial transparency and control through frequent reviews of key bookkeeping tasks, such as transaction recording and reconciliations.

- Optimised outsourcing outcomes by combining professional external expertise with vigilant internal oversight.

- Use of advanced bookkeeping software tools like QuickBooks, Xero and other leading cloud-based bookkeeping platforms, which allow efficient communication, accuracy tracking and financial visibility through interactive dashboards.

Best Practices for Monitoring Outsourced Bookkeeping

Business owners should actively engage with their bookkeeping service providers by:

- Routinely reviewing transactions, reconciliations and payroll processing.

- Ensuring bank feeds and financial data are accurate and properly categorised.

- Leveraging reports and dashboards from top bookkeeping software to monitor financial health remotely.

- Assigning internal oversight roles focused on regular transaction and reconciliation checks.

- Establishing clear communication channels and documentation of monitoring activities to promptly address any discrepancies or concerns.

By adopting these practices and technologies, businesses maintain control over their financial records and reduce the risk of errors or delays in bookkeeping processes, thereby supporting smoother financial management and organizational growth.

How to establish a strong monitoring framework for Outsourced Bookkeeping?

Preparation is the foundation of successful monitoring especially when engaging with outsourced bookkeeping services or outsource bookkeeping solutions. Before starting an outsourcing arrangement, ensuring that expectations and responsibilities are clearly defined contributes to smoother service delivery and easier oversight. Without a structured preparation phase, it becomes difficult to hold providers accountable or to identify issues early, increasing the risk of errors or delays.

Setting clear agreements and scope

- Define specific bookkeeping tasks being outsourced, such as transaction processing, reconciliations, payroll and report preparation.

- Establish clear deadlines for data submission, reporting and statement lodgement.

- Outline communication protocols, including points of contact, response timelines and escalation steps for issue resolution.

- Include a clause for data confidentiality and compliance with Australian laws like the Privacy Act 1988 (Cth).

Verifying provider credentials

- Confirm your provider or bookkeeping outsourcing company is registered and follows industry standards for accountability.

- Check licensing, certifications (e.g., Xero Partner or QuickBooks ProAdvisor) and client testimonials to validate reliability.

- Ensure the provider demonstrates experience working with Australian SMEs and reporting standards.

- Always opt for a bookkeeping company that follows good supervisory practices, ensuring offshore or third-party work is competently reviewed.

Access and permissions

- Provide role-based access within cloud accounting platforms like QuickBooks Online, Xero, or MYOB depending on responsibilities.

- Choose the best accounting software for bookkeepers to ensure real-time visibility and transparency across your financial data.

- Implement internal controls such as two-factor authentication, encrypted data sharing and periodic password rotation to strengthen bookkeeping data security outsourcing.

- Before signing, confirm the outsourcing company uses platforms licensed under your business account, a cybersecurity best practice that maintains ownership and compliance.

Establishing record-keeping policies

- Align document retention policies with industry requirements, keeping records for typically a minimum of five years.

- Develop internal protocols for digital file storage, including secure backups and version control.

- Regularly audit record-keeping practices to ensure completeness, accuracy and organisation.

Assigning internal oversight roles

- Assign a team member responsible for daily reviews of bookkeeping outputs and daily transactions.

- Define responsibilities including monthly reconciliations and regular communication with the outsourced provider.

- Ensure the oversight role includes maintaining documentation of monitoring activities and addressing discrepancies promptly.

How to prevent errors and fraud with effective controls in Outsourced Bookkeeping?

Proactive prevention is vital to minimise the risk of errors and fraud. Controls help reduce error risk and improve trust between businesses and outsourced accountancy and bookkeeping providers. Preventive controls reduce dependency on reactive problem-solving and establish a clear layer of checks that safeguard the books. Implementing these controls also builds a framework of trust and accountability between the business and outsourced provider.

- Multi-level approvals to prevent unauthorised transactions.

- Segregation of duties to limit access and reduce errors or fraud.

- Activity tracking within software to monitor user actions.

- Timely reconciliations to spot errors or missing entries early.

Additional best practices for 2025 include:

- Use of cloud-based accounting platforms with robust audit trails and automated alerts for suspicious activity.

- Regular review of access logs and permissions to ensure only authorised personnel can perform critical tasks.

- Scheduled internal audits and reconciliations to detect and correct discrepancies promptly.

- Clear communication protocols and documentation for all bookkeeping activities to enhance transparency and accountability.

These controls help ensure that outsourced bookkeeping remains accurate, secure and aligned with your business’s operational standards, without relying on reactive measures.

How to monitor key Bookkeeping tasks for quality and accuracy?

Monitoring ensures outsourced work maintains quality and accuracy. Placing focus on essential bookkeeping activities is important to ensure that business records remain accurate and complete. Each task, from transaction recording to superannuation contributions, plays a role in maintaining the integrity of bookkeeping data that the business relies on for decision-making.

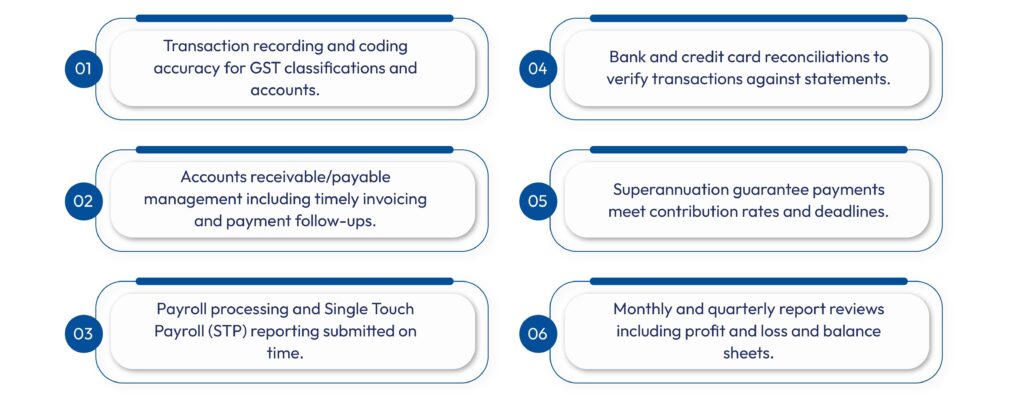

Focus Areas for Monitoring:

- Transaction recording and coding accuracy for all accounts.

- Accounts receivable/payable management including timely invoicing and payment follow-ups.

- Payroll processing and reporting submitted on time.

- Bank and credit card reconciliations to verify transactions against statements.

- Payment contributions meet set rates and deadlines for employee benefits.

- Monthly and quarterly report reviews, including profit and loss and balance sheets.

Best practices for monitoring these tasks:

- Conduct regular audits to verify data accuracy and completeness.

- Use cloud-based bookkeeping software for live tracking and efficient reconciliations.

- Establish clear checklists and approval steps for each activity.

- Implement automated alerts for deviations or missed deadlines.

- Maintain transparent communication and documentation with outsourced providers.

- Assign internal staff to review outsourced outputs and ensure timely follow-ups.

Focusing on these activities with structured controls helps maintain reliable financial records and improves the overall accuracy of your bookkeeping process.

How to simplify Bookkeeping Monitoring with Accounting Software and dashboards?

Modern accounting platforms have transformed the way businesses monitor bookkeeping. They provide transparency and simplify oversight by bringing important information to one accessible location. Leveraging features like dashboards and audit trails gives business owners and managers clear visibility of the bookkeeping process. This reduces the effort required to identify unusual transactions or missing entries and supports better communication with the provider.

- Automated bank feeds speed up transaction imports, reducing manual errors.

- Dashboards summarising bank balances, outstanding invoices and overdue payables.

- Audit trails that log every change, use and timestamp for accountability.

- Integrated reporting functions deliver summaries of important financial data and lodgement statuses.

Using software like QuickBooks Online, Xero or MYOB not only improves accuracy but also facilitates clear communication with providers. Simplify your financial oversight with Xero bookkeeping services, featuring real-time dashboards for clear business insights.

Step-by-step monitoring process

Daily tasks

- Review bank balances and transaction summaries via software dashboards.

- Check bank feeds are active and error-free.

- Spot-check recent transactions for duplicates or unusual entries.

Weekly tasks

- Audit a sample of transactions for correct account coding.

- Review accounts receivable/payable for overdue invoices or bills.

- Confirm invoices and bills are entered promptly.

- Examine journal entries for authorisation and appropriate documentation.

Monthly tasks

- Perform bank and credit card reconciliations, resolving unmatched items.

- Verify payroll accuracy and reporting is completed on time.

- Review financial statements for irregularities.

- Conduct meetings with the bookkeeping provider to discuss issues and progress.

Quarterly tasks

- Review draft reports and summaries well before submission deadlines.

- Validate collected and payable amounts against transaction data.

- Conduct full statement reviews for completeness and accuracy.

- Provide feedback and approve submissions.

How to protect your records from common Bookkeeping mistakes?

While proper monitoring minimises risks, it is also important to recognise warning signs that may indicate bookkeeping issues. Early detection can prevent escalation and more significant problems. Identifying concerns early allows businesses to work directly with providers to restore quality or escalate if necessary. Timely response is key to protecting business interests.

Common warning signs of problems include:

- Frequent transaction coding errors.

- Delayed entry of invoices or bills.

- Discrepancies between bank statements and bookkeeping records.

- Missing or late payroll payments.

- Lack of timely responses or unclear communication from the provider.

When issues arise:

- Escalate the concern immediately and request corrective action.

- Document all correspondence.

- Seek external advice from industry experts or professional bodies if needed.

Additional considerations for Offshore Bookkeeping Providers

Outsourcing bookkeeping overseas can offer cost benefits but requires extra caution to ensure quality and adherence with local expectations. Clear communication and strong data security measures become especially important with offshore arrangements. Providers must understand your procedures and deadlines to deliver effective services that meet your business needs.

- Ensure strong data security and privacy safeguards.

- Arrange regular communication despite time zone differences.

- Confirm offshore teams understand your requirements and deadlines clearly.

- Perform regular knowledge assessments or refresher sessions.

Maintaining a productive relationship with your provider

A strong partnership with your bookkeeping provider helps maintain service quality and facilitates smooth issue resolution. Having regular check-ins establishes trust and keeps work aligned with your business goals. Transparent communication and clear expectations reduce misunderstandings and improve overall performance quality.

- Schedule regular meetings to discuss progress and challenges.

- Set clear expectations on communication, deadlines and performance.

- Maintain confidentiality of business data.

- Provide timely feedback and address concerns constructively.

Conclusion

Monitoring your outsourced bookkeeping services is not just a best practice, it’s essential for financial accuracy and business resilience. By establishing clear agreements, leveraging top accounting software and implementing preventive controls, businesses can fully realise the benefits of outsourcing bookkeeping while maintaining control over their financial data.

Regular oversight, proactive communication and the use of modern dashboards help ensure that your outsourced accounting and bookkeeping services remain accurate and aligned with your business goals. Effective monitoring supports good bookkeeping practices and maximises the value of your partnership with a bookkeeping outsourcing company.

Start today by implementing a monitoring checklist and scheduling regular review meetings to stay in control of your finances. For expert support, contact Outbooks Australia at info@outbooks.com.au or call 0451 320 102.

Frequently Asked Questions

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.