Business owners wear numerous hats and oversee many elements of their organisation. You work hard to expand your business, but the tax deadlines, payroll, receipts, invoices, and spreadsheets always perplex you.

There is always something to do, from sales and marketing to hiring personnel and overseeing everyday operations. However, as your company expands, so will the administrative chores. Accounting is one area that many business owners find particularly difficult.

Outsourcing accounting operations is a great way to eliminate these time-consuming tasks. Many businesses outsource their accounting duties to specialised professionals to improve cash flow, minimise total cycle time, and identify the most and least profitable product lines for future expansion plans.

Accounting Tasks You Must Outsource Right Away

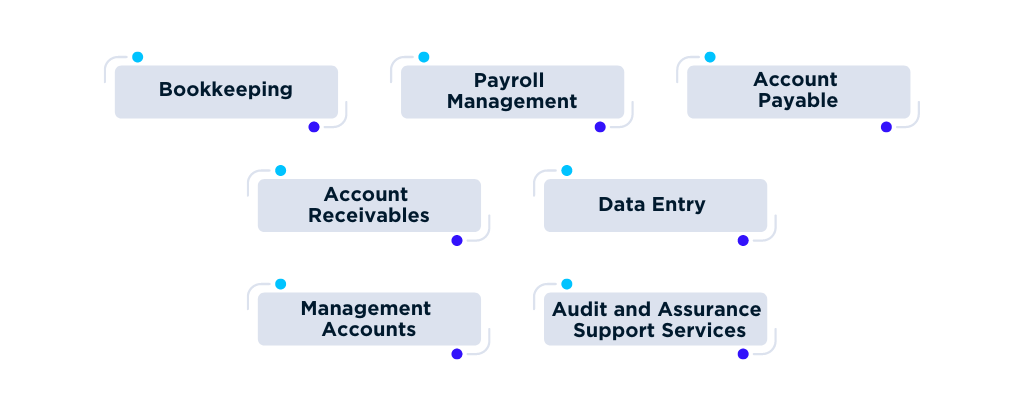

Accounting, from tax deadlines and payroll to receipts, invoices, and spreadsheets, may be time-consuming and difficult. Outsourcing accounting work, fortunately, can be an excellent choice for freeing yourself of this strain and focusing on what you do best: expanding your business. Here are the accounting operations you can outsource to ease your burden:

- Bookkeeping

- Payroll Management

- Account Payable

- Accounts Receivables

- Data Entry

- Management Accounts

- Audit and Assurance Support Services

Businesses can benefit from specialised expertise, cost savings, and increased efficiency by outsourcing key accounting responsibilities. It enables businesses to focus on their core skills, improve decision-making with accurate financial data, and remain in compliance with tax and regulatory regulations. In this competitive environment, outsourcing accounting operations is a wise decision that allows firms to survive and succeed.

Accounting and Bookkeeping Outsourcing – What Is It?

Accounting outsourcing is a business management technique in which an outsourced accounting firm handles a company’s accounting and financing functions.

It simply means paying an independent contractor or accounting firm to manage your compliance and accounts rather than handling them yourself.

However, most small businesses do not outsource their accounting processes because they do not understand how it works.

How Does Accounting Outsourcing Work?

One of the benefits of outsourcing bookkeeping is that you pay for the services you require.

An outsourced services provider will examine your needs and how they might help you achieve your goals. After evaluating your requirements, they will provide a proposal outlining their services and associated expenses.

New systems or accounting software apps are introduced to improve your operations and give better data security. These outsourcing firms work with accounting professionals and advanced technology to improve internal controls or increase efficiency for your business.

Why Is Outsourcing Accounting Services a Growing Trend in Australia?

Outsourcing accounting services is becoming a growing trend in Australia, and there are several reasons behind it:

Seamless Tax Season

Tax season is always a difficult time. A well-organised accounting management system helps you lay a solid foundation for a successful tax season free from additional stress.

In addition, outsourcing firms make sure you take your time doing accounting tasks before tax season starts. These exceptionally skilled people will free up more time for your internal professional to concentrate on tax season. When the time comes, they file your tax returns accurately, quickly, and efficiently.

Access to Pool of Technology Experts

Access to accounting and business technology professionals is one of the main advantages of accounting outsourcing. These business professionals have received training on applying accounting standards and best practices and put in place tools and systems that allow financial data to be integrated throughout the company.

These experts ensure your business stays updated with emerging technology always to be competitive.

Enhanced Operational Efficiencies

The outsourced accounting team will first build and optimise a software-based financial system using a mix of automation and integration. Additionally, automating the billing and collection process reduces invoice preparation costs and time, and faster collection enhances cash flow. They will also help you with:

- Lowers the accounting labour cost

- Expedites the process of producing reports

- Provides more detailed reports

- Minimises human errors

- Reduces the possibility of fraud

Comprehensive Analysis of Financial Reports

One benefit of outsourcing bookkeeping is the financial expertise and data that goes along with it. Your financial reports are available for quick and easy viewing, giving you the knowledge to examine the specifics and make informed decisions. You can review your profits, losses, cash flow history, and balance sheet.

Since they have a clear and organised way of storing information, going through the reports becomes very easy and quick. Then, without any alterations or simplifications, the stakeholders can quickly obtain this information.

Focus on Core Objectives and Cost Efficiency

Always choose a reliable outsourcing firm that eases your accounting operations at a low cost. Any function unrelated to your company’s core competency distracts resources from operations that should be outsourced.

Outsourcing helps to access accounting professionals and tax advisors at significantly cheaper costs without sacrificing quality.

When is the Right Time to Outsource Your Accounting Operations?

These are the ideal and crucial times for your company to use outsourcing services:

- Small firms don’t need a full-time bookkeeper; they need someone with more skills than the office manager or receptionist can provide.

- Finding a full-time worker with all the abilities required for small enterprises can be challenging.

- It would help if you outsourced when your company needs temporary services, such as for end-of-year reports, filing taxes, auditing purposes, or a full-time employee taking a vacation or maternity leave.

- A developing business always looks for ways to scale its bookkeeping and accounting operations.

Even if you engage a competent and skilled worker, someone must authorise bills, process payments, and analyse timesheets. So, outsourcing your in-house operations in the circumstances mentioned above is ideal.

Wrapping Up

Outsourcing is a Powerful Way to Manage Accounting Operations…

There are several compelling reasons to outsource bookkeeping to Australia. Businesses can improve operational efficiency and encourage long-term success by using outside knowledge, upgrading technology, and focusing on core competencies.

Outsourcing accounting is a smart tactical move for businesses looking to prosper in Today’s competitive market, offering cost savings, improved data protection, compliance, and real-time financial reporting.