Switching bookkeepers can be a challenging process, but sometimes it’s necessary to improve your financial management or find someone better suited to your business needs. Changing bookkeepers is a major undertaking and should ideally happen only once every five years to avoid disruption and extra costs.

A smooth transition starts with a new bookkeeping client checklist and a bookkeeping checklist for new clients to structure tasks and timelines. Use a bookkeeping client onboarding checklist and a new accounting client checklist to manage access, documents, and responsibilities during accounting client onboarding.

Gather details via a bookkeeping new client questionnaire and client onboarding questions, then log them in a new bookkeeping client information sheet and a new bookkeeping client intake form.

We’ll cover each step, including templates, the bookkeeping workflow checklist, the checklist for bookkeeping services, and when to use an accounting transition checklist and a new client checklist QuickBooks.

Why switching Bookkeepers is challenging?

Before diving into the steps, it’s important to understand why switching bookkeepers is not as simple as it seems:

- Transition of knowledge about your financial systems, history, and processes must be done carefully to avoid errors.

- Switching might require resetting your accounting system, which can be costly and disruptive.

- Changing bookkeepers disrupts tasks like month-end close and bank reconciliations temporarily.

- Bookkeeping is built on trust and communication. Starting fresh with a new bookkeeper means rebuilding this relationship from scratch.

- Setting up a new bookkeeper often involves cleanup work and extra hours, which can increase your costs initially.

Planning a seamless switch with zero downtime? Explore our accounting & bookkeeping services to streamline onboarding, secure data handover, and stabilize monthly closes from day one.

How to switch bookkeepers smoothly?

Below are the steps to change bookkeepers, these will help you to do the transition smoothly:

1. Assess your current situation

- Evaluate why you want to switch. Is it due to poor service, high costs, or lack of industry expertise? Use a client checklist to capture issues clearly and begin accountant onboarding considerations.

- Consider whether the issues can be resolved with your current bookkeeper before deciding to switch.

- Aim for a long-term relationship with your new bookkeeper — ideally five years or more.

2. Find the right new bookkeeper

- Look for bookkeepers who know your business type and understand the computer programs you use. Shortlist using a new bookkeeping client checklist, a bookkeeping checklist for new clients, and a bookkeeping new client checklist to compare providers.

- Read what others say about them, ask for people who can say they do good work, and make sure they’ve worked with businesses like yours.

- Check that they will help with the move and clean-up work, including the bookkeeping onboarding process and accounting onboarding tasks.

3. Plan the transition timeline

- Avoid abrupt changes. Plan for an overlap period where both the old and new bookkeepers can work together. This is essential when onboarding bookkeeping clients and managing accounting client onboarding.

- Communicate your timeline clearly with both parties and align it with a bookkeeping workflow checklist.

- Consider incentivising your current bookkeeper service to stay on temporarily to assist with knowledge transfer.

4. Notify your current Bookkeeper professionally

- Inform your current bookkeeper in writing about your decision to switch. Reference the accounting transition checklist so both parties know the handover scope.

- Request their cooperation in handing over all necessary records and information, including any new accounting client information sheet requirements.

- Be transparent and professional to maintain goodwill and encourage smooth collaboration.

5. Organise knowledge transfer

Create a detailed knowledge transfer plan covering:

- Key financial processes and workflows aligned to a bookkeeping information checklist and a checklist for bookkeeping services.

- Access credentials to accounting software, bank accounts, payroll systems and other relevant platforms captured via a new client onboarding questionnaire and onboarding questionnaire for new clients.

- Historical financial data, reconciliations, and reports logged via a new bookkeeping client information sheet.

- Schedule meetings or calls between the outgoing and incoming bookkeepers for direct knowledge exchange.

- Use templates or checklists to ensure no critical information is missed, such as a bookkeeping client onboarding checklist template or a bookkeeping client checklist template.

It is an important step in switching bookkeepers process. Keep reading to know more.

6. Getting your money systems ready

- Check which money tracking tool you’ll use going forward (like QuickBooks or Xero). Add a new client checklist QuickBooks to avoid setup gaps.

- Make sure your new money helper knows how to use this tool and can complete an accounting client onboarding checklist template if needed.

- If changing to a new tool, plan how to set it up, move your info over, and learn to use it with support from the bookkeeping workflow checklist.

Related Post: Xero Bookkeeping | Accountants, Bookkeepers & More

7. Gather and share needed papers

- Collect all important papers like bank papers, bills, worker pay records and receipts, guided by an accounting firm new client checklist and a know your client checklist for accountants.

- Use safe ways to share files with your new money helper; where relevant, include a virtual assistant onboarding questionnaire or a virtual assistant new client questionnaire.

- Set clear dates for when papers must be given to keep things moving smoothly and align with onboarding bookkeeping clients milestones.

8. Sign engagement and confidentiality agreements

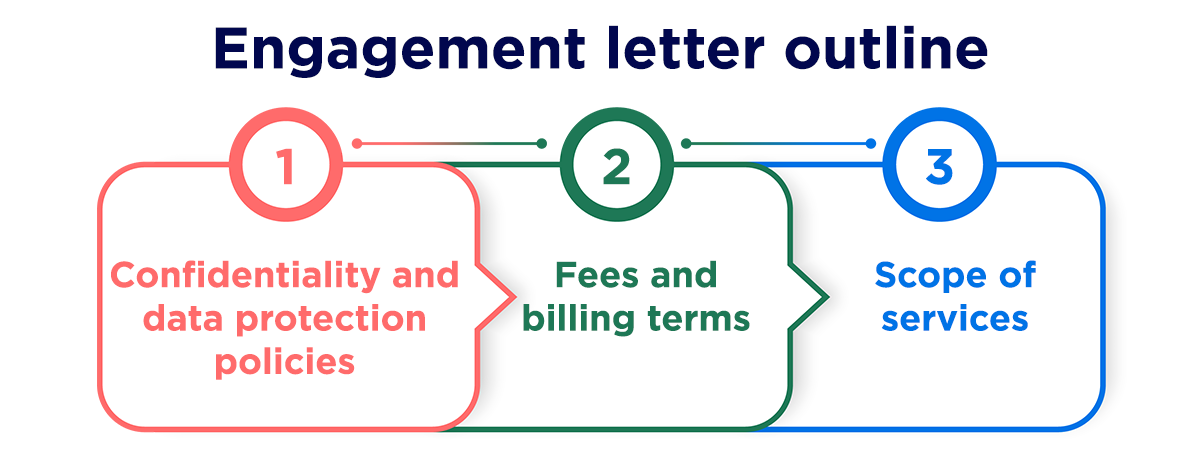

- Formalise your relationship with the new bookkeeper through an engagement letter and a new bookkeeping client intake form.

- Complete any required identification or anti-money laundering checks, using a new client checklist for accountants or a law firm new client checklist if legal input is needed.

9. Manage cleanup and catch-up work

- Understand that cleanup work is often necessary to bring your books up to the new bookkeeper’s standards. A bookkeeping client onboarding questionnaire can surface gaps early.

- Discuss and agree on the scope and cost of catch-up work upfront, referencing the checklist for bookkeeping services and monthly bookkeeping checklist for clients.

- Be patient; cleanup can take time depending on how long bookkeeping was neglected or handled poorly. Tools like the Hubdoc bookkeeping client onboarding checklist can streamline document capture.

10. Monitor the transition progress

- Maintain regular communication with your new bookkeeper and use client onboarding questions to resolve blockers.

- Review initial reports and reconciliations carefully against the bookkeeping client onboarding checklist.

- Address any onboarding questions for new clients promptly to avoid delays.

11. Close out with your old Bookkeeper

- Ensure all outstanding work and invoices are settled as per the accounting transition checklist.

- Obtain confirmation in writing that they have ceased acting on your behalf.

- Secure copies of all transferred records for your files, and archive the new accounting client information sheet.

| Document Type | Purpose |

| Bank Statements | For reconciliation and cash flow tracking |

| Invoices | To verify sales and accounts receivable |

| Payroll Records | To ensure employee payments |

| Historical Financial Reports | For reference and continuity in reporting |

| Access Credentials | For accounting software, bank accounts, payroll systems |

Following the above points will help you change bookkeeping services smoothly.

Following the above points will help you change bookkeeping services smoothly while maintaining a complete new bookkeeping client checklist trail end‑to‑end.

Bookkeeping transition checklist

- Be Transparent: Honest communication with both bookkeepers to avoid problems.

- Set Realistic Expectations: Understand that the first stage of working together takes the most time and work.

- Value Expertise Over Cost: It’s better to pay more for a bookkeeper who knows your field and your tools.

- Use Technology: Get bookkeeping programs and online spaces where you can share files and talk easily.

- Plan for the Long Term: Try to find a bookkeeper you can work with for a long time so you don’t have to keep changing.

Final thoughts

Changing who does your money work is a big move that needs good planning and talking clearly. It can be messy, but if you follow these steps one by one, you can change without problems.

Remember, you want to find someone who will help your business grow and keep your money matters right and true for many years.

Frequently Asked Questions

1. How can I ensure a seamless bookkeeping transition?

Plan carefully using a bookkeeping handover checklist and communicate clearly with both old and new bookkeepers to avoid disruptions.

2. What are the key steps for switching bookkeeping providers?

Notify your current provider, organise handing over bookkeeping records, and confirm your new provider has all necessary access to ensure continuity.

3. How do I avoid bookkeeping disruptions during the change?

Maintain open communication, overlap services if possible, and follow a structured bookkeeping handover checklist for a smooth process.

4. What is the best way to switch bookkeeping services without losing data?

Use a detailed bookkeeping handover checklist and coordinate closely with both providers to guarantee seamless transition to your new bookkeeper.

5. How do I ensure bookkeeping continuity when switching financial service providers?

Ensure all financial records are accurately handed over and confirm your new provider understands your business needs for uninterrupted service.

6. Why should I consider outsourcing bookkeeping services during a transition?

Outsource bookkeeping services can provide expert support and help manage the transition smoothly, reducing risks and ensuring bookkeeping continuity.

Parul is a content specialist with expertise in accounting industry. Her writing covers a wide range of domains such as, Accounts Payable, Accounts Receivables, Bookkeeping and more. She writes well-researched content and has a strong understanding of accounting terms and industry-specific terminologies. As a subject matter expert, she simplifies complex concepts into clear, practical insights, helping businesses with accurate tips and solutions to make informed decisions.