This blog post explores how Australian SMEs can leverage outsourcing accounting services to achieve significant advantages. Here’s what you’ll discover:

- Discover the rising importance of outsourcing accounting services for Australian SMEs.

- Explore the key benefits of outsourcing, such as cost savings, expertise, and improved financial management.

- Understand the signs indicating when it’s time for your business to consider outsourcing.

- Gain practical tips for successful outsourcing to enhance efficiency and mitigate risks.

Managing a business is not a piece of cake in Australia; you continuously confront business obstacles.

You have a lot on your plate, from finding and maintaining customers to complying with rules, managing finances, and creating a healthy work environment for your employees.

The struggle doesn’t end here; you have to balance your books, maintain all your transactions, file your taxes on time, and manage your payroll and cash flow for smooth business operations.

As Dave Ramsey also stated, “Ignoring your accounting and bookkeeping is like driving your car without looking at the dashboard – you might eventually crash and burn.”

All accounting compliance seems a nightmare for businesses. That’s why many businesses in Australia are adopting OUTSOURCING ACCOUNTING SERVICES these days.

Why Is Outsourcing Accounting Services a Growing Trend in Big Australian Cities?

It is absolutely correct that Australian businesses are embracing outsourcing; it’s an important trend to comprehend.

There are many reasons that many big cities like Sydney, Melbourne, Brisbane, Perth, and Adelaide are accepting outsourcing accounting services these days:

1. Outsourcing Accounting Services in Sydney

Adaptability is essential in Sydney’s fast-paced tech environment. Outsourcing allows internal teams to focus on innovation while professionals manage money, assuring compliance and accuracy without impeding growth.

Outsourcing provides more access to talent at competitive costs, allowing small businesses to get the expertise they require without breaking the bank.

2. Outsourcing Accounting Services in Melbourne

Melbourne businesses are recognised for being cost-conscious. Outsourcing saves significantly more money than hiring full-time accountants, freeing up capital for growth and expansion.

3. Outsourcing Accounting Services in Brisbane

Brisbane has a diverse economy that necessitates industry-specific skills.

Outsourcing connects organisations with accountants specialising in their sector, resulting in better financial management and strategic insights.

4. Outsourcing Accounting Services in Perth

Perth’s resource boom resulted in complex rules and taxes.

Outsourcing links organisations with accountants who understand these complexities, resulting in accurate reporting and increased profitability.

5. Outsourcing Accounting Services in Adelaide

Adelaide’s thriving startup culture necessitates quick-thinking and adaptable solutions.

Outsourcing provides the flexibility and scalability required for quick expansion, allowing businesses to focus on innovation and disruption.

How Does Outsourcing Accounting Benefit Small Businesses?

If you manage a startup or small business, you understand the importance of keeping correct financial records. You may also face time restrictions, an increased workload with limited resources, and a lack of funding to continue hiring onshore.

However, small businesses that outsource accounting tasks can SAVE MONEY, IMPROVE PRODUCTIVITY AND HAVE BETTER TAX COMPLIANCE, helping them keep up with their finances.

Here are the benefits of outsourcing accounting services for small businesses settled down in Australia.

Benefits of Outsourcing Accounting Services for Australian SMEs

1. Huge Cost-Savings, Not Cutbacks

If you are hiring in major cities like Melbourne and Sydney, it will surely be a huge investment for your business.

Hiring a full-time person to complete all these responsibilities will require you to pay for wages, taxes, office equipment, and other expenses.

You will simply have to pay accounting fees using an outsourced accounting firm for the same work.

By outsourcing, you can tap into a talent pool of experts with just a fraction of the cost, and you can choose to pay from their ENGAEMNET MODELS.

2. Expertise Beyond Your Backyard

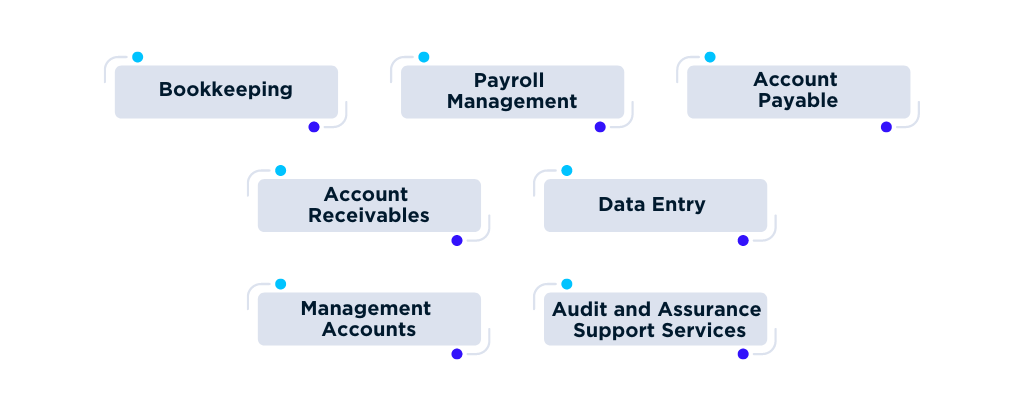

Accounting firms comprise trained accountants, bookkeepers, and tax agents with years of expertise assisting businesses.

Outsourcing your operations links you with competent accountants who are familiar with local nuances.

This ensures that your financial matters are handled precisely and in accordance with current rules and accounting standards.

3. Local Support, Global Reach

Choosing a local provider gives you the advantage of understanding your city’s distinct business environment and regulatory landscape.

But don’t be bound by geography! Many suppliers offer remote teams with global knowledge, giving you the best of both worlds.

So you would be getting both in one place; outsourcing gives you the flexibility to work with local support at a global reach.

4. Scalability and Flexibility

As your company grows, the accounting function and business operations may get more complex.

Outsourcing helps you scale your accounting and bookkeeping services according to client demands, market conditions, and new projects.

Whether you have seasonal swings or rapid development, an outsourced accounting company can adapt rapidly to match the changes, making it a more flexible option than retaining an in-house team.

5. Reduced Errors and Fraud

Professional accounting and bookkeeping services prioritise accuracy and security while handling financial data.

Outsourcing your accounting activities reduces the risk of costly errors and potential fraud, which can occur when depending entirely on internal staff.

Reputable accounting firms use strong security procedures and regulations to protect sensitive financial information, giving you peace of mind.

6. Easy Tax Compliance

As a business owner, you may forget to meet the crucial dates on the Australian tax calendar owing to job stress or other obligations.

Missing these dates may result in penalties or fines. Professional accounting organisations will ensure you meet your tax duties and penalties.

When to Outsource Accounting Services for Your Business?

There is no single RIGHT TIME for choosing outsourcing operations.

Every company has unique needs or struggles with different prospects and factors. But some signs indicate that it is the GOOD TIME to OUTSOURCE ACCOUNTING SERVICES:

When Does Your Business Need Outsourcing Services?

1. Struggling with Financial Tasks

If your business cannot operate daily accounting operations or is struggling to maintain the bookkeeping records, you need to outsource accounting services.

2. Lacking In House Expertise

You should consider outsourcing if you need expert assistance and your in-house team lacks expert consultation.

3. Skill Shortage

Many big cities and companies in Australia are facing the challenge of skill shortages.

Outsourcing helps you meet a global talent pool in a single place, and you don’t need to struggle with a skill shortage.

4. Focus on Core Objectives

If your focus is just your business and you don’t want to spend time with mysterious spreadsheets, accounting ledgers, or mismatched transactions, then OUTSORCING is a better option.

5. Budget Constraints

Hiring a full-time expert can cost you a lot, while outsourcing gives you the benefits of doing the same activities at a low cost.

6. AR and PR Inefficiency

If accounts receivables and payables management is becoming chaotic for your accounts department, it is the right time to outsource your AR and AP operations.

If you are going through any of these issues, you must outsource your accounting operation without giving it a second thought.

Tips on How Outsourcing Works for Your Business

Even though outsourcing is continually developing and beneficial to all firms, you must understand the best tactics for outsourcing accounting to maximise its benefits.

Tip #1: Understand your requirements – you must know exactly what type of accounting task you want to outsource. Knowing your specific requirements will allow you to select the best partner to assist you.

Tip #2: Create a budget – before hiring any accounting services, calculate the expenses and compare them to the value of the services you’ll receive.

Tip #3: Select the appropriate source – your outsourcing partner should be able to match your objectives and standards.

Tip #4: Communication is essential; investing time in your partnership will make working with an outsourced accountant easier. Provide comments and do meaningful check-in calls or meetings.

Tip #5: Set expectations – Make sure you understand and set what is expected of both parties to guarantee that quality is not compromised and that everyone’s demands are met.

Outsourcing Services Are Your True Financial Aly!

Outsourcing can be an excellent way to save time and money, but it’s important to understand its risks. But with proper research and selecting a reliable outsourcing provider, you can reduce risks while increasing benefits.

This article will work as a reputable guide for outsourcing accounting services if you’re considering outsourcing and why it is a growing trend in Australia.

This will enable you to make an informed decision regarding whether or not outsourcing is an appropriate and suitable option for your business.